Sabadell's Q3 net profit beats forecasts on higher lending income

Bbreaks down net interest income, new guidance

MADRID, Oct 26 (Reuters) - Spanish bank Sabadell's SABE.MC third quarter net profit beat forecasts on Thursday with a 46% year-on-year increase thanks to higher lending income, which offset a decline in new mortgages and margin pressure at its British unit TSB.

Spain's fourth-largest bank in terms of market value reported a net profit of 464 million euros ($491 million) in the July to September period.

Analysts polled by Reuters expected a net profit of 383 million euros.

Spanish banks, which are predominantly retail lenders, are benefiting from higher interest rates.

Sabadell's net interest income, earnings on loans minus deposit costs, rose around 29% year-on-year in the quarter to 1.24 billion euros, slightly higher than the expectations of 1.2 billion euros.

For 2023, the bank raised its NII growth guidance to around 25%, compared to a previous growth forecast of more than 20%.

($1 = 0.9483 euros)

(Reporting by Jesús Aguado; editing by Inti Landauro)

(([email protected]; +34 91 835 68 32; Reuters Messaging: Reuters Messaging: [email protected]))

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

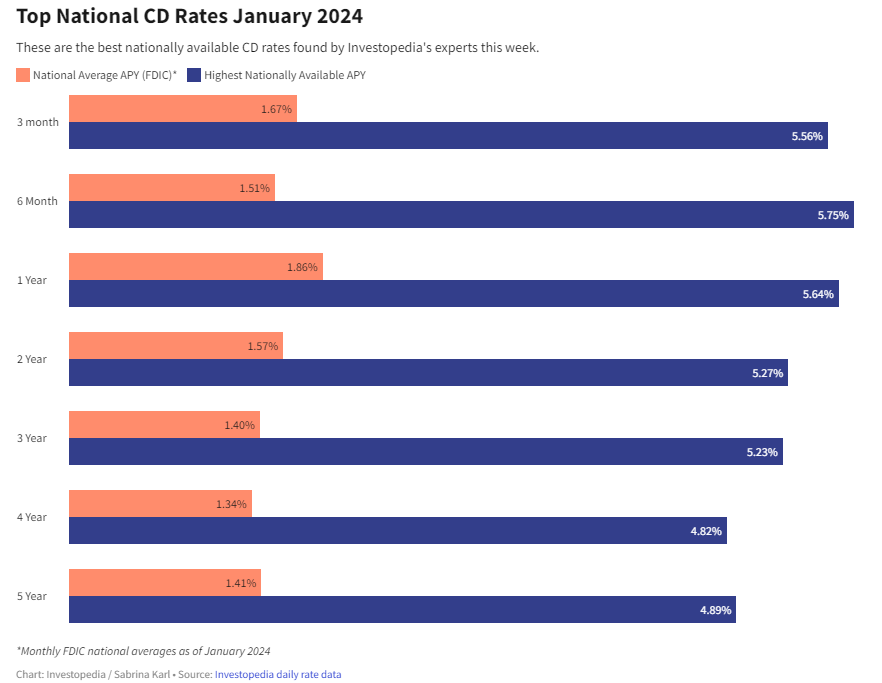

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

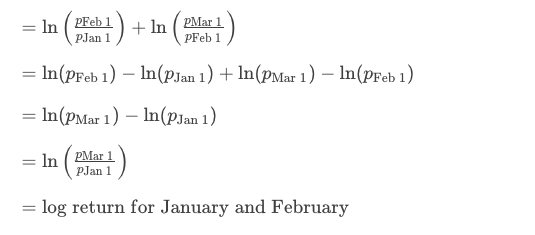

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create