Fixed Income Inflows Surge Due to Attractive Yields

2023 has been a volatile year for bonds due to a better than expected economy and hawkish Federal Reserve. Yet, inflows into bond funds are up 38% compared to this time last year at $235 billion according to Blackrock.

The firm sees fixed income demand driven by high yields and the desire to reduce portfolio volatility. Currently, the 10 year Treasury is yielding 4.6% which is 90 basis points higher than at the start of the year. In contrast, the 10 year was yielding around 1% in October 2021.

Currently, the central bank is in a ‘wait and see’ mode regarding further hikes and the duration of the current cycle. Wall Street analysts anticipate that flows should further pick up once it’s clear that the tightening cycle is over as they look to lock in yields at these levels.

In terms of fixed income ETFs, the iShares 20+ Year Treasury Bond (TLT) has been the biggest beneficiary with $17 billion of net inflows YTD despite a 13% drop. However, there is less enthusiasm for riskier fixed income due to concerns that a recession could lead to a spike in defaults as inflows into lower-rated bond funds have lagged.

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

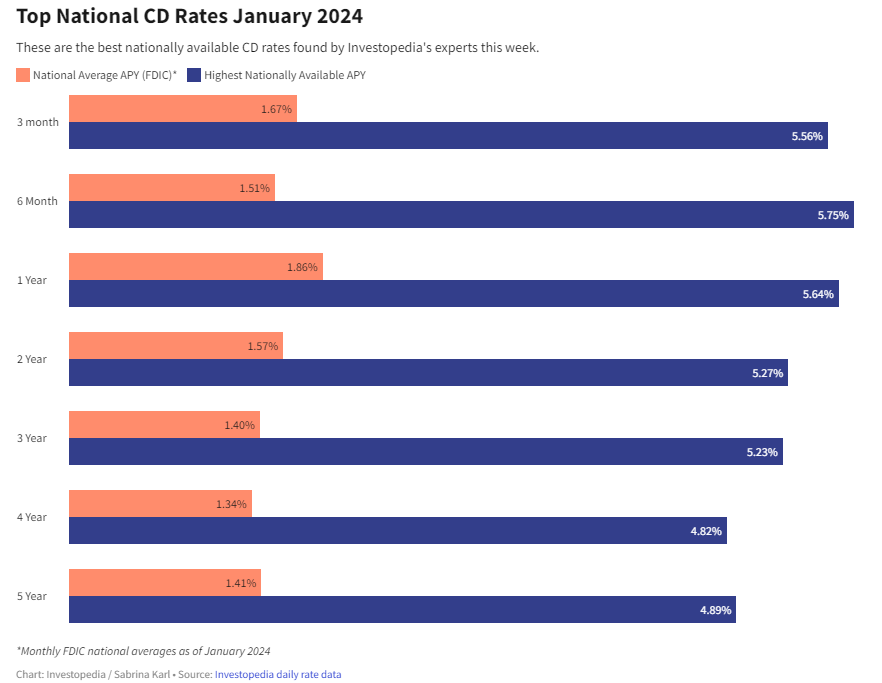

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create