Model Portfolios Free Up Time for Client Services

Often, there is a mismatch between how an advisor spends his or her time, and what drives ultimate success for the practice. By embracing technology and model portfolios, advisors can free up more time to invest in activities that build their business such as client service, marketing, and prospecting.

Surveys show that client retention and satisfaction are ultimately linked to frequent communication. However, many advisors are spending a chunk of their time managing portfolios and researching investment ideas. In fact, some research indicates that advisor-managed portfolios underperform especially in more volatile markets.

Now, there are increasingly more complicated and sophisticated investment options which increases the burden on advisors and further compromises client services. With model portfolios, advisors can outsource large parts of the process such as research, portfolio management, and onboarding while providing more options and better performance.

By outsourcing this function, advisors can also reduce costs and create greater efficiencies. Model portfolios can also help in other areas such as tax management which is another priority for clients. By centralizing information, it can identify opportunities across portfolios and lead to a more personalized experience.

Ultimately, model portfolios are a way for advisors to leverage technology to drive better outcomes for their clients and business while creating a more efficient practice.

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

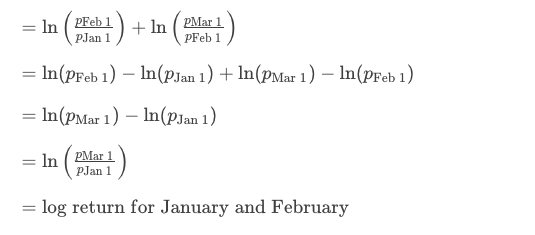

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create