Hidden Fees Cost Americans Billions — New Proposal Could Stop That

Junk fees sneak added costs past consumers looking to save money. To combat this, the Federal Trade Commission has proposed a new rule that could make pricing more transparent across the board.

The Federal Trade Commission (FTC) proposed a new rule last week that could impact the entire economy if approved. The FTC received over 12,000 complaints from American consumers in 2022 who were at wit's end with hidden “junk” fees. The FTC defines junk fees as "hidden and bogus fees that can harm consumers and undercut honest businesses."

Whether buying a concert ticket, booking a hotel, or choosing a new bank, junk fees may add to the advertised cost of the goods and services you’re shopping for. When looking for the lowest price, honest businesses that share the true cost are often undercut by businesses advertising a lower price and tacking on additional fees later.

The proposed rule would prohibit businesses from separating or hiding junk fees from the cost of the firm's product or service. Instead, businesses must disclose the full mandatory cost upfront or face enforcement actions from the FTC such as providing refunds or paying monetary penalties.

Fees generate tens of billions for businesses

In an endorsement of the new FTC rule, President Biden stated, “Folks can end up paying as much as 20% more because of hidden junk fees than they would have paid if they could see the full price upfront.” White House research backing this statement shows that junk fees generate billions in revenue for companies across multiple industries with the following estimates:

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

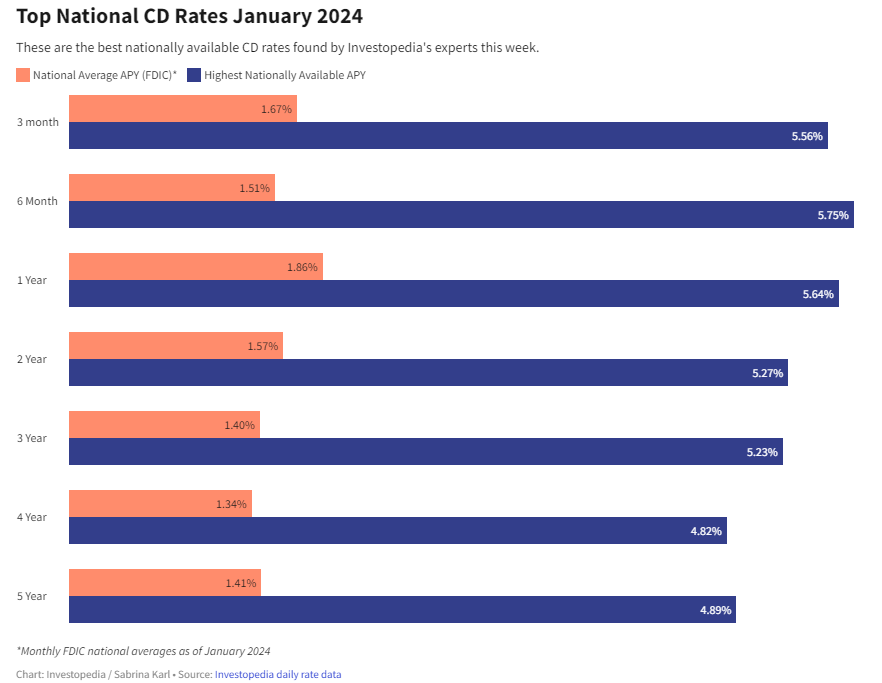

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create