Here’s the Income You Need To Be a Securely Middle Class Family — and 4 Ways To Make the Jump

In America, it’s good to be rich. But if millionaire status isn’t quite in the cards just yet, middle-class security isn’t too shabby of a goal.

But how much do you have to make to be a member of the middle class and how can people lock in their spot if their salary comes up a little short?

Discover: 6 Ways To Become Rich on an Average Salary

Check Out: 5 Ways To Elevate Your Finances Daily

GOBankingRates asked the experts.

A Middle-Class Income Is $50,000 to $150,000

Broadly speaking, you can count yourself as a member of America’s middle class if your earnings fall within a specific $100,000 salary range.

“For a family of three to five, a middle-class designation typically means an annual income ranging from $50,000 to $150,000,” said Jake Claver, a finance expert with a Qualified Family Office Professional (QFOP) certification and the founder of the wealth management firm Digital Family Office.

If that seems like an overly broad span, there’s a reason the spectrum is so vast.

“The definition of middle income ranges from earning two-thirds to double the median household income,” said CFP and The Ways To Wealth founder R.J. Weiss, who cited the Pew Research Center’s widely accepted definition of the term.

I’m a Financial Advisor: 7 Ways To Get Rich in Your Later Years

The Median Income Where You Live Is the Only One That Matters

According to the U.S. Census Bureau, the national median household income in the United States is just shy of $75,000. Two-thirds of that amount is $50,000, and double that is $150,000, which validates Claver’s numbers to the penny — but it all depends on where you live.

“The exact figures fluctuate across different geographic regions,” Weiss said. “For instance, in California, where the median income is $84,097, the middle-class income bracket ranges from $56,065 to $168,194.”

But California is a big place — as is every state in terms of regional income fluctuations. To get it right, use the Fannie Mae Area Median Income (AMI) Lookup Tool to find the precise median income where you live. If you earn two-thirds to double that amount, congratulations: Your family is in the middle class.

If not, don’t worry. There are steps you can take to achieve middle-income security.

Not There Yet? Making the Leap to the Middle Class

People who earn less than $50,000 can budget, save and invest toward a higher status, and those who make more than $150,000 can spend and mismanage their way into poverty, but your financial habits can’t technically buy you into or out of the middle class.

“Although savings can contribute to overall wealth accumulation, especially when spending is kept below earnings over extended periods, it doesn’t directly factor into the definition of the middle class,” Weiss said. “The fundamental strategy for families aiming to elevate to the middle class primarily revolves around increasing their income. Of course, this is much easier said than done — but there are a few smart options.”

Consider Strategic Job Switching

Research shows that if your current job doesn’t pay you a middle-class wage, a new employer might.

“Data suggests that individuals often secure higher wages when they switch jobs,” Weiss said. “A proactive approach in periodically seeking higher-paying job opportunities can significantly boost a family’s income. The Wage Growth Tracker by the Federal Reserve Bank of Atlanta provides insightful data on this idea.”

Enhance Your Skill Set

You have a much better chance of earning a higher wage with a different employer if you bring new skills to your new job.

“Coupling job switching with acquiring valuable skills pertinent to one’s career field amplifies the potential for income growth,” Weiss said. “Investing time and resources in gaining certifications, attending workshops or pursuing further education can render individuals more marketable and eligible for higher-paying roles.”

Relocate

If you can’t boost your income to at least two-thirds of the AMI where you live, consider moving to a place with a lower AMI, if your occupation supports mobility.

“For those with the flexibility to work remotely, relocating to regions with lower median incomes while maintaining or even increasing their current earnings can be a strategic move,” Weiss said. “This not only potentially places a family within the middle-class bracket in the new locale but also could lower living expenses.”

Add Another Earner — Or Another Income

If a spouse, partner, roommate, adult child or anyone else in your household left the workforce to raise a child, go back to school or for any other reason, their re-entry into the labor market could be your ticket to the middle class.

“Two incomes are often needed,” said Fluent in Finance founder Andrew Lokenauth, a financial planner and Wall Street veteran who held leadership positions at JP Morgan, Goldman Sachs and Citi. “It’s tough on one income given the costs of housing, healthcare, education, etc. Dual incomes provide more flexibility.”

If no second income earner is available, the answer might be a second income stream.

“Supplement your pay with side income,” Lokenauth said. “Freelance gigs, renting out unused space or driving for Uber can provide extra income.”

More From GOBankingRates

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

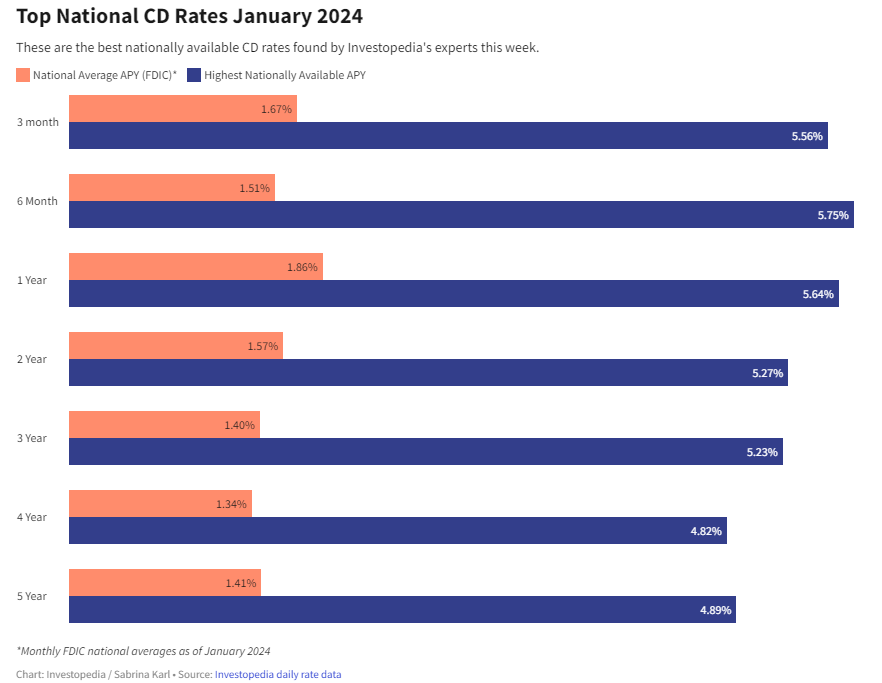

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

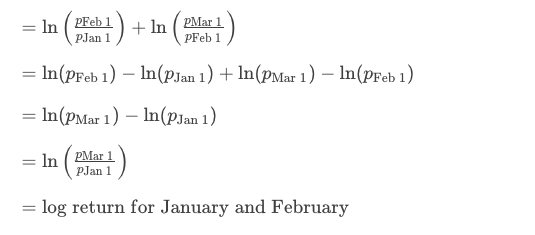

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create