Grant Cardone Says Home Ownership Should No Longer Be Part of the American Dream: ‘For Most People It’s a Nightmare’

For many people, the “American Dream” includes a home with a white picket fence. But Grant Cardone, author of the upcoming book “The Wealth Creation Formula,” believes that the white picket fence ideal is actually a money trap.

Housing Market 2023: The 10 Most Overpriced Housing Markets in the US — 5 Are in Florida

Find Out: 3 Things You Must Do When Your Savings Reach $50,000

“The very things that symbolize the middle class — cars, homes and college — are strangling, suffocating and dismissing the middle class as a wealth class,” he told GOBankingRates.

‘You’re Trapped for 30 Years’

One of the reasons Cardone sees homeownership as a trap is that you are physically trapped in the same place, usually for 30 years.

“You have to live in the same place every day for 30 years and pay for it,” Cardone said. “It is a terrible, terrible investment. What about if, in year three years, you have this great opportunity to move to another part of the country or part of the world in order to have a better job — you couldn’t, because you have 27 years left on your loan. It would be much smarter to pay $2,000 a month rent for the next 30 years.”

Renting ultimately gives you more financial freedom and flexibility than owning, Cardone said.

“You still have your down payment, you don’t have to pay insurance, you’re not stuck,” he said.

I’m a Real Estate Agent: 12 Costly Red Flags I Look For During a Home Inspection

If You’re Buying a Home as an ‘Investment,’ There Are Better Places To Put Your Money

Many people see buying a home as an “investment,” but Cardone points out that the ROI on single-family homes is much lower than other assets you could put your money into.

“The return on a house as an investment [is lower compared to] the S&P 500 and other real estate investments, like I make,” he said. “Investing in bonds would even be better than investing in a house.”

Once you pay a down payment, that money no longer grows.

“The money is dead,” Cardone said. “Your down payment’s lost. [Plus], you have to service the debt every month.”

If you buy a home with the plan to flip it for a profit in 10 years, the reality is that you probably will not be able to, Cardone said.

“If you took a loan out and you’re going sell the house in 10 years, you have to make 70% on the sale of that house just to pay the interest,” he said.

“You’re also going to have to pay a real estate brokerage firm 6% on the way out, so now you’ve got to make 76%. And you have to pay the property insurance — in Florida, the property insurance is 2% a year — so now you’ve got to make 70%, plus the 6%, plus 2% [times 10 years, which is] 20%. So you have to make almost 100%. The house has to appreciate 100% in 10 years for you to break even — and you lost your mobility.”

Homeownership Is More of a Nightmare Than a Dream

Cardone believes we need to stop considering homeownership as part of the “American Dream,” particularly if you will need to take out a 30-year mortgage to pay for that dream.

“The house, for most people, is a nightmare — not a dream,” he said. “At the very least, it’s a trap. Warren Buffett has one home, Elon Musk has none. It’s only until you’re wealthy [and don’t need to take out a mortgage] that you should go out and buy a house.”

More From GOBankingRates

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

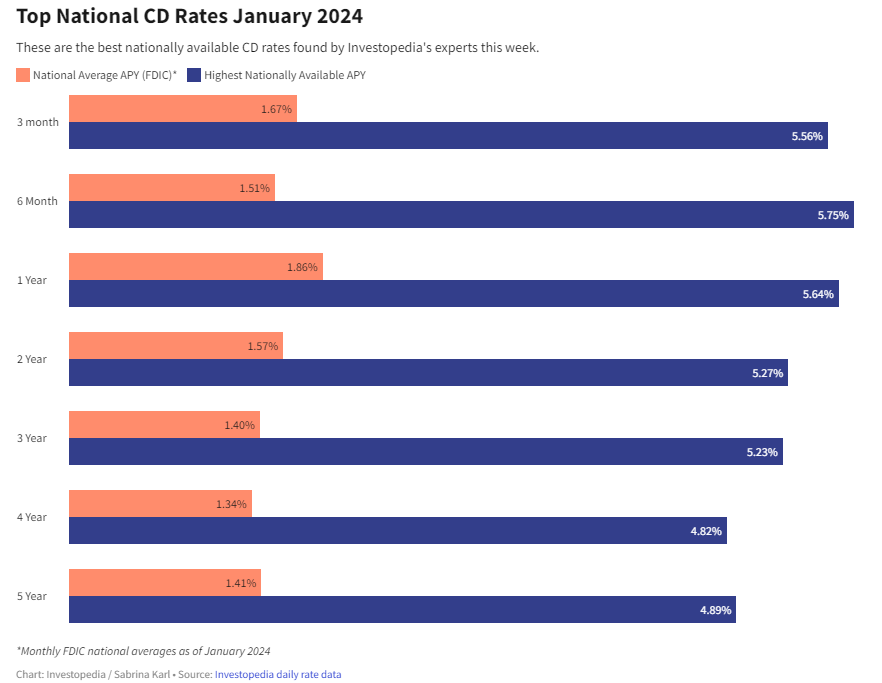

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create