Food Stamps: All the Ways You Can Qualify for SNAP and Which States Participate Most and Least

The U.S. Department of Agriculture adjusts SNAP income and resources limits, maximum allotments and more each fiscal year to account for the cost of living. Most households who meet SNAP guidelines are eligible for monthly benefits.

Food Stamps: What Is The Maximum SNAP EBT Benefits for 2024?

Learn: How To Get Cash Back on Your Everyday Purchases

When calculating eligibility and benefit amount, the USDA says households must meet:

- Gross and net income limits: Income must be at or below 130% of the federal poverty line.

- Resource limits: Assets must fall below $2,750 for households without a member aged 60 or older or who has a disability and below $4,250 for households with such a member.

- Word requirements: Able-bodied adults without dependents can receive SNAP for only three months in a three-year period if they don’t work at least 80 hours per month. This applies to ABAWDs between the ages of 18 and 52, excluding homeless people, veterans and adults ages 18 to 24 who aged out of foster care.

SNAP counts cash income from all income before payroll taxes are deducted and unearned income, such as unemployment insurance and Social Security. Families with no net income receive the maximum allotments. For households with net income, the monthly SNAP benefit equals the maximum benefits for that household size minus 30% of the household’s net income, according to the Center on Budget and Policy Priorities.

Food Stamps: 4 Changes to SNAP Benefits Happening For Fall 2023

Here is the gross monthly income limit for U.S. households at 130% of the poverty level for federal fiscal year 2024, which began in October 2023.

| Household Size | 48 States, D.C., Guam and the Virgin Islands | Alaska | Hawaii |

|---|---|---|---|

| 1 | $1,580 | $1,973 | $1,817 |

| 2 | $2,137 | $2,670 | $2,457 |

| 3 | $2,694 | $3,366 | $3,098 |

| 4 | $3,250 | $4,063 | $3,738 |

| 5 | $3,807 | $4,063 | $4,378 |

| 6 | $4,364 | $5,456 | $5,018 |

| 7 | $4,921 | $6,153 | $5,659 |

| 8 | $5,478 | $6,849 | $6,299 |

| Each additional member | $557 | $697 | $641 |

SNAP also considers assets when determining eligibility, which are resources that could be available to households to purchase food, like money in your bank account. Items that aren’t accessible, including your home, retirement savings and personal property, do not count, CBPP noted.

However, not all states have the asset test, and many residents qualify as long as they don’t exceed the SNAP income limits based on their household size.

Nationwide, 12.5% of the population received SNAP benefits, but some states participate more than others.

For example, 22.9% of residents in New Mexico receive SNAP benefits, according to the Pew Research Center, the highest of any state. The next highest was the District of Columbia, where 21.4% of residents receive SNAP, followed by Oregon (17.8%) and West Virginia (17.7%).

Utah had the lowest rate of SNAP use (4.6%), followed by New Hampshire (5%), Wyoming (5.1%) and North Dakota (5.8%).

More From GOBankingRates

- Top 7 Countries with Zero Income Tax

- 19 Dangerous Scam Phone Numbers and Area Codes To Avoid

- 3 Ways to Recession Proof Your Retirement

- 5 Ways to Elevate Your Finances Daily

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

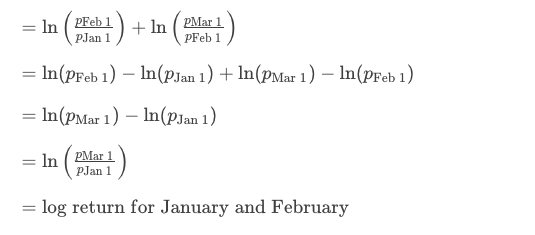

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create