How Much Does It Cost To Live in America’s ‘Retirement’ States?

Retiring can be terribly expensive — to the point where many Americans fear they won’t be able to make the transition into retirement comfortably. According to new Gallup research, 71% of non-retired Americans are at least moderately worried about being able to fund their retirement — and 42% percent of this group say they are very worried.

David Bach: Here’s Why You Should Start Collecting Social Security ASAP

More: The Simple, Effective Way To Fortify Your Retirement Mix

Where you live during retirement is a crucial factor, as it determines, in part, how far your money can go. With that in mind, here’s a look at the top 10 states with the highest percentage of Americans over the age of 65 — according to the Population Reference Bureau — and what the states have to offer for retirees, as well as how much the cost of living is in each.

South Carolina

- Percentage of people 65 and older: 18.7%

- Annual cost of living: $63,113

According to U.S. News & World Report, the following cities in South Carolina are the best for retirees, based on affordability: Columbia, Charleston, Spartanburg, Greenville and Myrtle Beach. The Palmetto State is relatively budget-friendly, with the cost of living about 5% lower than the national average.

Florida’s Retirees Are Fleeing: Here’s Where They’re Going Instead

Related: Here’s What the Average Social Security Payment Will Be in Fall 2023

Pennsylvania

- Percentage of people 65 and older: 19.1%

- Annual cost of living: $65,723

Pennsylvania abounds with tax-friendly retirement policies. It has no income taxes on Social Security benefits or pensions for those 60 and over. It’s also pretty affordable, with the cost of living being 2% lower than the national average, according to RentCafe.

Also: 5 Places To Retire That Are Just Like Florida but Way Cheaper

New Hampshire

- Percentage of people 65 and older: 19.3%

- Annual cost of living: $77,703

New Hampshire is considered a great state for retirees, largely because it is so tax-friendly. Social Security income is not taxed, nor are withdrawals from retirement accounts or pension plans.

But it’s not a particularly affordable state to dwell in. The cost of living in New Hampshire is about 16% more than the average state.

Hawaii

- Percentage of people 65 and older: 19.6%

- Annual cost of living: $123,148

Ah, to retire in Hawaii! It’s a common dream, but alas, not a very feasible reality for most Americans. Hawaii is the most expensive state to reside in. For example, the cost of living in Honolulu is 84% higher than the national average.

Montana

- Percentage of people 65 and older: 19.7%

- Annual cost of living: $70,141

With its abundance of natural scenery, Montana can be a truly beautiful place to hang up your hat. And it’s good for retirees based on its tax-friendly policies.

Depending on where you live, it’s about on par with the national average.

Watch Out: 14 Key Signs You May Run Out of Money in Retirement

Delaware

- Percentage of people 65 and older: 20.0%

- Annual cost of living: $70,676

There are a couple of good financial reasons driving so many retirees to live in Delaware. The state has no sales tax and property taxes are pretty low.

The only drawback is that Delaware is not especially cheap. Cost of living there is actually 6% higher than the national average.

Vermont

- Percentage of people 65 and older: 20.6%

- Annual cost of living: $77,570

There are a number of attractive places in Vermont for retirees — plus, so much gorgeous nature! — and it doesn’t hurt that the cost of living is on par with the national average.

West Virginia

- Percentage of people 65 and older: 20.9%

- Annual cost of living: $60,235

West Virginia has struggled with its reputation, largely because it struggles severely with high poverty rates. But prospective retirees may rejoice in the fact that it’s a pretty affordable state to reside in. Cost of living here is 8% lower than the national average, according to RentCafe.

Retired but Want To Work? Try These 8 Jobs for Seniors That Require Little to No Experience

Florida

- Percentage of people 65 and older: 21.3%

- Annual cost of living: $68,802

Pretty much everyone by now knows that Florida is an oasis for retirees, and so it makes sense that such a big percentage of residents in the state are 65 and older.

Aside from being tax-friendly, is it a good place to live in retirement? It could be, as cost of living is just 1% higher than the national average, according to RentCafe.

Maine

- Percentage of people 65 and older: 21.8%

- Annual cost of living: $77,168

Maine has quite a few draws. It’s got a comparatively low crime rate, a great healthcare system and incredible natural scenery. But Maine is not without its cons for prospective residents.

It has high property and income taxes, and the cost of living is about 11% higher than the national average, according to the Missouri Economic Research and Information Center.

Photo Disclaimer: Please note photos are for representational purposes only. As a result, some of the photos might not reflect the locations listed in this article.

More From GOBankingRates

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

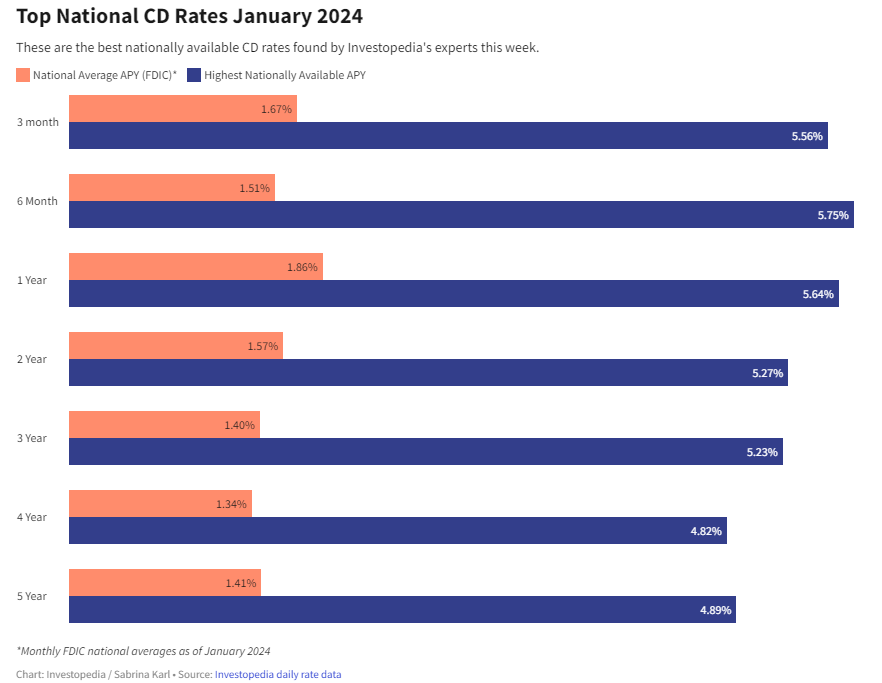

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create