DINK (Dual-Income No Kids) Households Are Less Likely To Own a Home: Here’s Why

Owning a home has lots of advantages. You can build credit, customize your home to your liking, build equity, avoid rent increases and qualify for tax deductions. But homeownership isn’t for everyone — even when finances aren’t an issue.

I’m a Real Estate Agent: Don’t Rent an Apartment If It Has Any of These 10 Problems

Learn: 3 Things You Must Do When Your Savings Reach $50,000

A recent study from Rocket Mortgage analyzed data from the U.S. Census Bureau’s Current Population Survey to compare dual-income households with no kids — DINKs — to dual-income households with kids — DIWKs. The study found that although DINKs usually earn more, they are less likely to own a home than those people who earn a dual income and have kids. Here’s why.

DIWKs vs. DINKs Earnings

When it comes to annual earnings, DINKs earn more than DIWKs in about 50% of the states in the nation. According to the study, dual-income houses with no kids earn $138,000 per year, on average, which is nearly 7% more than the $129,000 average annual income of dual-income families with kids.

The states where DINKs earn more by the largest margin are the following:

- Connecticut: 70%

- Rhode Island: 62%

- Illinois: 41%

But a higher income doesn’t mean that homeownership is a given.

Read: Kevin O’Leary Says a Coming Real Estate Collapse Will Lead to ‘Chaos’ – Here’s What You Need To Know

DIWKs vs. DINKs Homeownership

Even though dual-income households with no kids often earn a higher average income than dual-income households with kids, its DIWKs that are more likely to own their own home, according to the study.

Across the nation, 72% of DIWKs own homes, compared to 59% of dual-income houses with no kids. Overall, in 39 U.S. states, DIWKs are more likely to be homeowners than DINKs.

DINKs: Homeownership by State

Although DINKs are less likely to own a home than DIWKs, homeownership percentages for DINKs vary greatly according to the state.

In Mississippi, a whopping 93% of dual-income households with no kids own their own home. Among DINKs in Maine and New Hampshire, 88% and 86%, respectively, own their own home.

However, in New York, only 37% of DINKs own their own home, followed by 32% in D.C. and only 22% in Hawaii.

Why Dual-Income No Kids Households Are Less Likely To Own a Home

According to the study, DINKs may be less likely to own a home for the following reasons:

- Freedom and flexibility afforded by renting instead of buying

- No worries about potential impacts on a child’s schooling or social life

Zach Bromley, financial advisor at Broadway Graham Wealth Partners offered some common reasons, based on his past experience, why DINK households may be less likely to buy a home compared to households with children.

Less Need for Space

“DINK households often don’t require larger homes with multiple bedrooms, yards, good school districts etc. that families with kids prize.” Bromley said. “Smaller condos or apartments may suffice for many.”

According to the U.S. Census Bureau, the median size of a new single-family home sold in 2022 was 2,383 square feet, whereas the median size of multifamily units built for rent in 2022 was 1,010 square feet — or less than half the size of a single-family home.

Increased Mobility

A policy research brief from the MacArthur Foundation stated that moving during childhood can interfere with school performance, social skills and behavior. However dual-income houses who do not have to consider children’s needs can take advantage of increased mobility.

“Without kids tying them down, DINK couples may be more open to frequently moving for new job opportunities,” said Bromley. “This makes renting more practical than owning.”

Later Nesting

“DINK couples may be getting married and settling down later in life,” Bromley said, “delaying homebuying decisions compared to prior generations.”

According to the U.S. Census Bureau, the average first-time groom is 30, while the average first-time bride is 28, compared to being 25 and 22, respectively, in 1980.

However, that doesn’t mean they are immediately buying a home. The National Association of Realtors’ 2022 Profile of Home Buyers and Sellers found the average age of a typical first-time homebuyer is 36, which is considered an all-time high.

More From GOBankingRates

- Robert Kiyosaki Shares 7 Steps To Reach Your Financial Goals

- Which Bank Gives 6% Interest on Savings Accounts?

- 3 Things You Must Do When Your Savings Reach $50,000

- This Mistake Can Tank Your Credit Score 100 Points Overnight

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

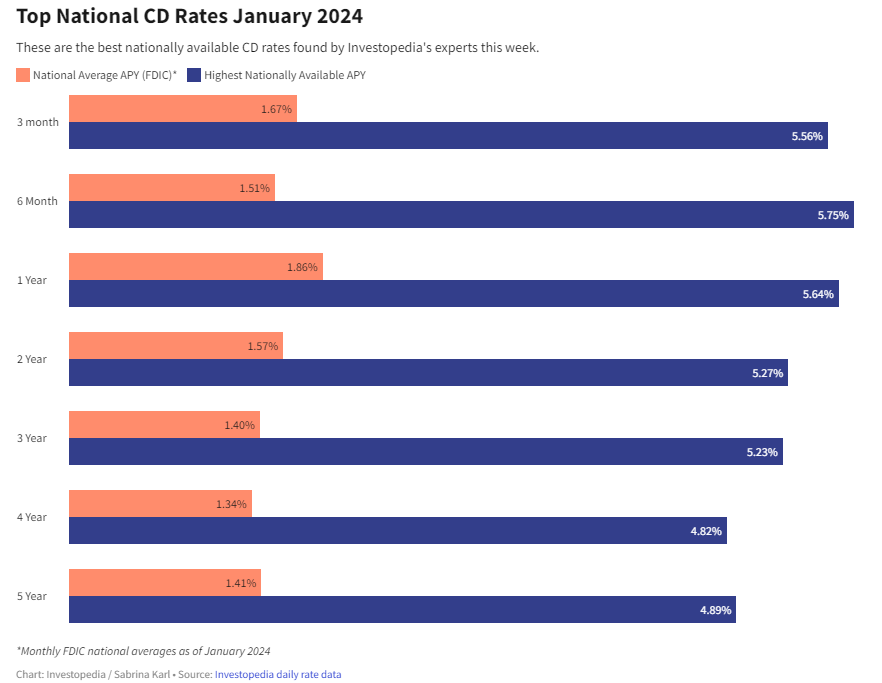

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create