RBC Nabs Miami-Based Merril Lynch Group

The steady stream of brokers exiting Merrill Lynch continues as the Ruccio Group, based in Miami and managing $1.37 billion, left for RBC Wealth Management. The team is led by Jeremy J. Ruccio and is composed of 2 advisors and 6 client associates.

In a statement, Ruccio attributed the decision to wanting to retain the group’s personalized attention and smaller firm feel with the resources, leverage, and insights of a global financial institution. Ruccio started at Merrill Lynch in 2008 and was ranked #24 on Forbes’ best in state wealth advisors list this year and #29th on the America’s best next generation wealth advisors list in 2021.

Currently, RBC has around 2,100 brokers and has $544 billion in client assets. Although its wealth management division is smaller than many of its peers, it’s had success in recent years luring brokers from larger firms. To compare, Merril Lynch and parent company, Bank of America, have over 19,000 advisors across its wealth management division.

Last week, it lured a $450 million team from Morgan Stanely which was based in Philadelphia. In September, it recruited a 41-year Merrill broker who managed $340 million in assets. In the prior month, RBC landed a UBS team based in Atlanta which had $5.5 billion in client assets and $22 million in annual revenue.

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

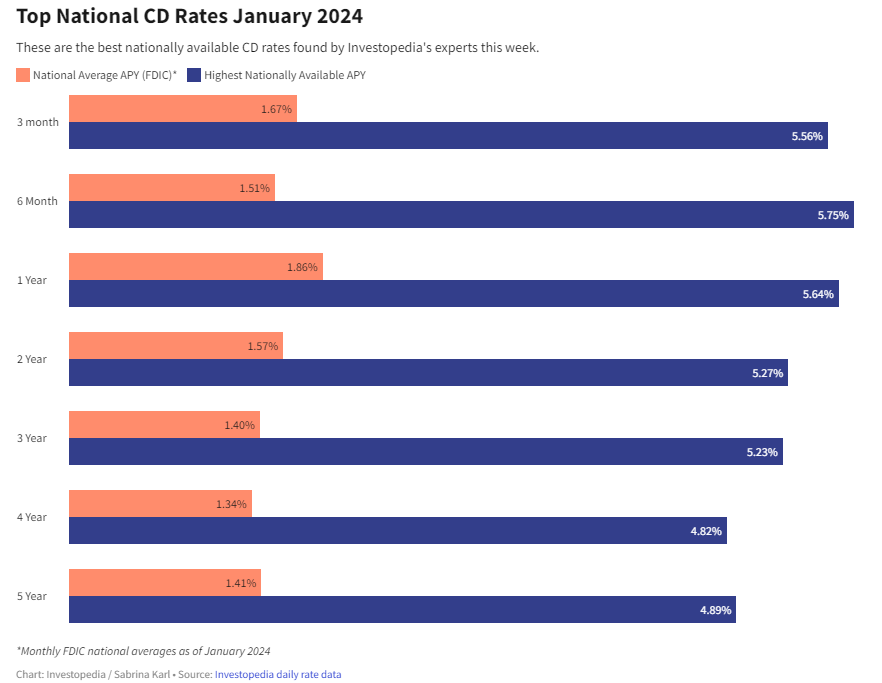

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create