Social Security 2023: Recent Study Shows Quarter of Americans Underestimate Their Benefits By $5,000

Many older Americans are pleasantly surprised when they receive their first Social Security check. According to a new study from the National Bureau of Economic Research (NBER), people tend to underestimate the amount of their future benefits and wind up receiving more than they expected.

How To Go From Broke in Your 40s to a Millionaire in Your 50s: 8 ‘Late Start’ Retirement Tips

Discover: The Simple, Effective Way To Fortify Your Retirement Mix

But while more money is always welcome, any incorrect assessment of Social Security can throw a wrench in retirement planning and invite unwelcome surprises.

Recipients Are Accurate About Age — Amount, Not So Much

The NBER study found that older adults tend to accurately assess the age they’ll claim Social Security, but lowball the benefit amount they anticipate receiving — and many are way off.

The average person underestimates their benefit amount by $1,896, an 11.5% miscalculation relative to the average benefit received — but 25% misjudged their benefits by $5,167 or more.

On the other end of the spectrum, 10% overestimate their benefits by at least $5,319.

Who Could Stress About Getting More Than They Had Planned?

Winding up with a bigger monthly check than you expected is not ideal — accurate retirement planning is. One danger of lowballing your benefits is that a bigger Social Security payment could increase your taxable income and actually cost you money in retirement.

But there are more immediate risks to consider.

“If seniors underestimate their Social Security benefits, they might be saving more than necessary or living too frugally, missing out on the quality of life they could have in their retirement,” said Dennis Shirshikov, a finance professor at the City University of New York and head of growth at Awning.com. “On the other hand, it could push some into risky investments in an attempt to boost their retirement income.”

Shirshikov shared a story about a family friend whose parents invested heavily in a volatile, high-risk stock as a Hail Mary to catch up on what they thought were insufficient retirement savings. Like so many in the NBER study, they had underestimated their monthly Social Security payment.

“They were not experienced investors and ended up losing a significant amount of their savings when the stock tanked,” he said. “This situation could have been avoided if they had a more accurate understanding of their Social Security benefits.”

Retired But Want To Work? Try These 8 Jobs for Seniors That Require Little to No Experience

Why Are Beneficiaries Missing the Mark?

While many of the NBER study’s respondents were more accurate in assessing their retirement age than their benefits, the age you claim has a greater impact on the size of your payment than nearly anything else.

“Confusion often stems from the fact that one can start receiving Social Security benefits at age 62 and then up to age 70 with amounts varying by age,” said Renee Fry, CEO of the estate planning platform Gentreo. “The benefit received per month is higher the longer one waits to start receiving benefits.”

The SSA reduces benefits by 5/9 of 1% every month you claim before full retirement age. If you claim at 62 when your full retirement age is 67, as it is for those born in 1960 or later, you’ll suffer a 30% reduction that turns a $1,000 monthly check into $700.

Conversely, if that same recipient waited to claim until age 70, they’d receive 124% of their benefits and a $1,000 monthly payment would become $1,240.

Retirement Age Is Only One Cause of Confusion

The study revealed that most people accurately estimate the age they’ll claim benefits, so why are so many of them misjudging the size of their benefits?

“One possible explanation is that seniors may not fully understand how Social Security benefits are calculated or may not have access to accurate information about their potential benefits,” said Al Kushner of Real Easy Medicare and author of “10 Costly Medicare Mistakes Financial Planners Make and How to Avoid Them.”

“Additionally, some seniors may assume that their benefits will be reduced due to factors such as income or changes in Social Security laws, leading them to underestimate the amount they’ll receive.”

‘A Critical Gap’

Shirshikov concurs with Kushner’s assessment that many seniors are simply unclear about the details of the highly complex Social Security system.

“It strikes me as a critical gap in financial literacy, specifically around the complexities of Social Security,” he said. “Many people may not fully grasp the variables at play — such as work history, age at retirement and spousal benefits — which can drastically impact the final payout. They may underestimate their benefits due to this lack of understanding.”

Shirshikov offered an anecdote to illustrate his point.

“I recall a student from one of my finance classes who was unaware that spousal benefits existed,” he said. “She had assumed that her Social Security benefit would be strictly based on her earnings history, unaware that she could receive benefits based on her husband’s earnings history, which was much higher.”

The good news is that you have tools at your disposal to get it right. “Many Americans also don’t know that the federal government via the Social Security Administration, www.SSA.gov, provides a free estimate of how much one will receive on a monthly basis,” said Fry. “It’s a great tool for planning for the future so as not to be guessing about how much you will be receiving.”

More From GOBankingRates

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

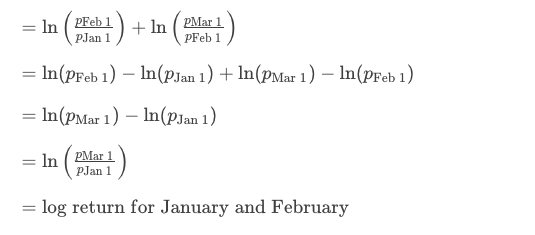

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create