I’m a Financial Advisor: These Are the Worst Money Mistakes I See Retirees Make

Retirement is a rewarding chapter in one’s life. This is the time where retirees may start creating a lifestyle based on their values and goals. If you’re not careful, however, you might find yourself making mistakes which can deplete your retirement savings.

GOBankingRates spoke to Michelle Francis, financial planner and owner at Life Story Financial, and Jim Eutsler, CFP and wealth advisor at HCM Wealth Advisors.

These are the worst money mistakes they see retirees make.

Retired but Want To Work? Try These 8 Jobs for Seniors That Require Little to No Experience

Also: The Simple, Effective Way To Fortify Your Retirement Mix

Spending Too Much of Their Savings

It’s not uncommon for retirees to want to put some of their nest egg toward a major expense during the early years of retirement, like a vacation condo or new RV. However, Francis said it can be a mistake for retirees to reason they will have plenty of time to replenish the savings they just spent.

“This money needs to last a long time and being able to earn gains over a longer period might be better because of the power of compound interest,” said Francis.

Retirees who want to make a major purchase during their retirement may consider going about it one or two ways:

- Talking about it with their financial advisor or with someone else who previously made a similar purchase. Eutsler said doing this helps retirees ensure they are making an informed decision.

- Planning to fund this big expense with their salary while they are still working. Francis said this means retirees will be able to live mostly on the interest and gains earned on their retirement savings and other sources of income like part-time work in the early years of retirement.

Types of Retirement Plans: How To Choose the Right One for You

Taking Social Security Before Age 70

While retirees can begin taking Social Security benefits as soon as age 62, Francis recommends those in good health who expect to have a normal life expectancy delay taking this benefit until age 70.

Doing so means the retiree’s annual benefit increases up to 8% per year for each year past their full retirement age. It may offer a better return than a retiree will see on their retirement savings.

Forgetting About Potential Tax Consequences

A few examples of money mistakes Eutsler said can lead to tax consequences include selling stock to raise cash in a brokerage account, which can trigger an unintended tax liability, and making a traditional IRA withdrawal, which can move retirees into a tax bracket they prefer to stay below.

To avoid these or any other tax consequences, Eutsler recommends conducting multiyear tax planning with a financial advisor.

Moving Portfolios Too Far to One End of the Asset Allocation Spectrum

Sometimes this move isn’t always a money mistake. If a retiree’s financial plan allows it and they are comfortable with this decision, it can be okay to move to mostly cash or stocks.

However, Eutsler said there can be significant consequences in making this move. Retirees are recommended to speak with their advisor. “This decision should be made thinking of all possible outcomes. Your advisor can illustrate any impacts a decision like this can have on your lifetime assets.”

Falling For a Financial Scam

While financial scams are less discussed at the level of tax consequences and drawing Social Security early, seniors are among the most victimized and targeted age groups by fraudsters. In some cases, Francis said even unscrupulous financial advisors may try to sell retirees on a “winning investment” which promises to increase their retirement savings.

If it sounds too good to be true, it probably is. Before committing money to anything, Francis recommends doing some research online and running the idea by a trusted financial professional.

More From GOBankingRates

- Best Credit Union CD Rates for September 2023 -- Up To 7.19%

- Don't Shop at Wegmans on This Day of the Week

- 3 Things You Must Do When Your Savings Reach $50,000

- 14 Ways To Save $50 This Week While Running Errands

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

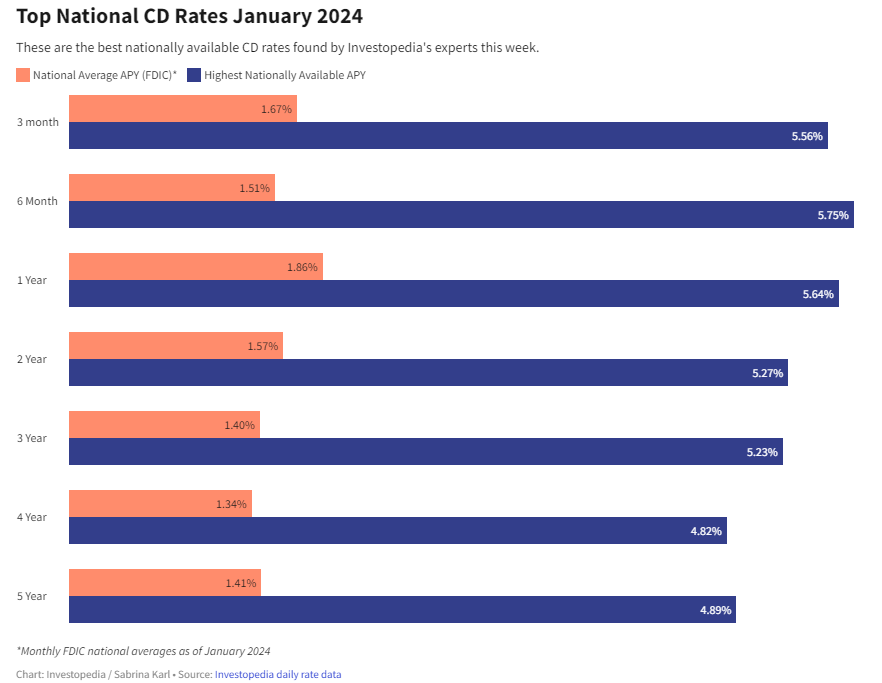

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

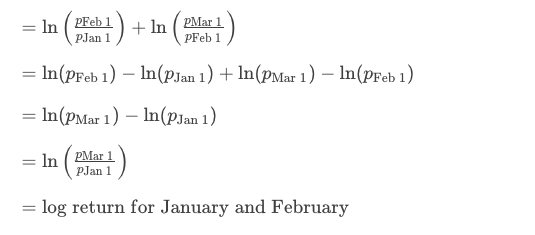

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create