Boomers: 5 Signs You’ll Never Be Able To Retire

Just because you’re a baby boomer “of retirement age” doesn’t mean you’re able to actually retire. Financial preparation, not age, is the key to a successful retirement.

Find Out: 6 Things Empty Nesters Should Stop Buying To Boost Retirement Savings

More: The Simple, Effective Way To Fortify Your Retirement Mix

While many Americans think that once they hang up their working shoes they’ll be able to retire thanks to savings, Social Security and/or a pension, the truth is that many won’t actually be ready. If you’re a boomer — typically defined as born between 1946 and 1964 — and you’re struggling to make it to retirement, it could be because of one of the signs listed below.

If you can address any of these issues, you may be able to someday make it to the promised land of retirement.

You Haven’t Reached Your Retirement Savings Number

The biggest and most obvious reason you won’t be able to retire is that you can’t reach your retirement savings goal. For example, if you need $40,000 per year to live on and you have just $100,000 in your retirement account, you’re not really in a position to retire. Sure, you could live for two or maybe three years off that money, but if it runs out and you have no real sources of income, you’ll be in a serious predicament.

While it might seem a bit late to start saving for retirement if you’re already 70 years old, if you’re on the younger side of the boomer spectrum — say, age 60 or so — you can continue to work and save for at least a few more years. That alone can be enough to help you reach your goal. Remember, the longer you work, the fewer years of retirement you’ll have to finance, so your savings target number will decrease every year.

How To Go From Broke in Your 40s to a Millionaire in Your 50s: 8 ‘Late Start’ Retirement Tips

You Have Too Much Debt

Debt is a financial killer no matter what your age. In your working years, debt pulls your cash flow away from your savings and investments, making it hard to reach your retirement savings goal and creating problem No. 1 above.

Debt is particularly troublesome if you are already in your 60s or 70s, as paying down debt and saving as much as possible at the same time may overwhelm your cash flow. If you have too much debt in your 70s, it can be hard to truly retire, even if you are making only minimum payments, so try to start addressing this issue as soon as possible.

You Don’t Have an Emergency Fund

While an emergency fund isn’t an absolute necessity to retire, it’s definitely a red flag if you don’t have one. A single large, unexpected cost could drive you into significant debt, which in turn would drain your cash flow. Suddenly, a retirement budget that covered all of your bases would have to divert significant resources to debt service.

Without enough money to cover basic expenses like rent and utility bills, you might fall deeper and deeper into a debt spiral from which you could not recover. This is why having an emergency fund is essential to being able to retire.

You Don’t Know How To Budget

In retirement, you’ll be trading your primary source of income for investment and Social Security income. Although your investment accounts may grow in value and your Social Security payments will adjust annually for inflation, this type of income is essentially fixed. If you don’t know how to budget around a fixed income, it’s likely that you’ll fall into a pattern of overspending.

Without the ability to track every incoming and outgoing dollar, it’s far too easy to spend money whenever you want. This almost certainly will drain your retirement savings prematurely. If you have neither the interest nor the ability to budget, you’re really not in a position to retire successfully.

The good news is that budgeting isn’t particularly hard — it just takes patience and dedication. Even if you’re already in your 70s, it’s not too late to learn how to budget.

You Can’t Imagine Life Without Work

Successfully retiring isn’t all about numbers. There’s a definite mental component to it as well. If, after a lifetime of working and socializing in an office, you’re not sure whether you’re ready for a life on your own, you might not be. If you don’t have outside hobbies or a plan for your life after you retire, retirement might actually end up being a chore, or outright lonely.

To avoid falling into this predicament, start thinking about exactly how you envision a successful retirement, and be sure to stock it with mentally stimulating activities.

More From GOBankingRates

- Suze Orman: 3 Things You Must Do If You Receive an Inheritance

- How To Get Free Money: 13 Proven Ways

- 3 Things You Must Do When Your Savings Reach $50,000

- 10 Smartest Ways to Make Your Money Work for You, According to Experts

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

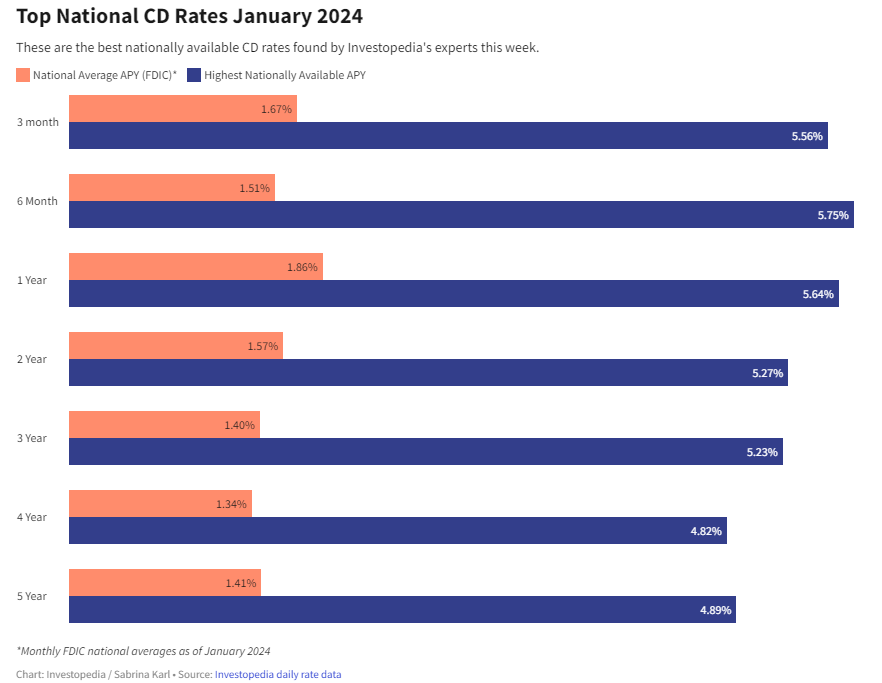

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

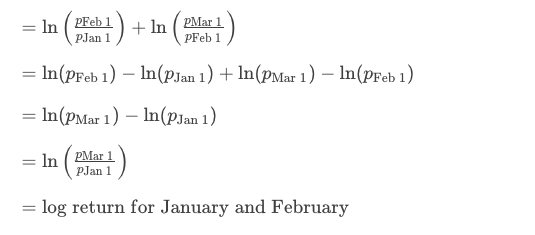

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create