The Average Credit Score Just Reached an All-Time High

Your credit score is key to your financial identity. It’s the metric that pretty much any lender uses to determine your worthiness as a borrower. So it’s great news that the average American’s credit score just reached a new high: It’s now 718, up a couple points from a year ago.

Financial data company FICO is behind the most popular measure of credit — the FICO Score — and its new report shows that FICO Scores have improved to a record high. The company says that higher employment and some medical debts being removed from credit reports are among the forces driving this improvement.

Why credit scores are rising

According to FICO, the average credit score is now 718, which is well into the realm that’s considered “good” credit. It’s the highest ever average score reported by the company, and the first increase since April 2021, when the average was 716. America’s average credit score has increased significantly during the pandemic years, rising from 708 in April 2020 to 718 today.

One reason for the recent improvement is that medical debts under $500 have been removed from Americans’ credit reports. Credit bureaus have been planning to do this for a long time, and earlier this year, they finished implementing the change. FICO says that while the change didn’t affect a huge number of borrowers, those who did have a medical debt removed from their report between April 2022 and April 2023 likely saw an increase in their FICO Score as a result.

FICO also points out that credit scores have inched higher partly because the unemployment rate has returned to pre-pandemic levels, near record lows. Naturally, higher employment means more Americans are earning wages, putting them in a better place to pay bills.

It’s worth noting that while credit scores are on average the highest they’ve ever been, so too is the level of credit card debt. Earlier in the year, the total credit card debt of all U.S. borrowers surpassed $1 trillion, or almost $6,000 per household.

All said, the fact that the average score is up doesn’t mean that the financial situations of their owners are improving, besides general credit worthiness.

How to improve your credit score

Having a high credit score can help you get approved for certain credit cards, as well as lower rates and better terms on mortgages, auto loans and more.

One of the best ways to improve your credit score is to make payments on time. Missed payments are a mark on your score, and timely ones are a sign of responsibility that will increase your score over the long haul. Setting up automated payments is a simple way to ensure that you’re doing this. Paying off outstanding balances is also a good idea.

If you can help it, keeping your utilization rate low also helps. Using 30% or less of the total amount of credit available to you is best. You should also avoid closing out credit accounts, as doing this can hurt your score. Instead, consider downgrading your less-used cards.

Finally, you can get a boost to your credit score by finding and reporting errors that are hurting your score. Getting delinquent payments or accounts that aren’t yours removed from your report will help your score.

Dollar Scholar

Still learning the basics of personal finance? Let us teach you the major money lessons you NEED to know. Get useful tips, expert advice and cute animals in your inbox every week.

More from Money:

6 Best Credit Repair Companies of 2023

3 Signs You’re Too Casual About Debt

How to Check Your Credit Score

© Copyright 2023 Money Group, LLC. All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer.

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

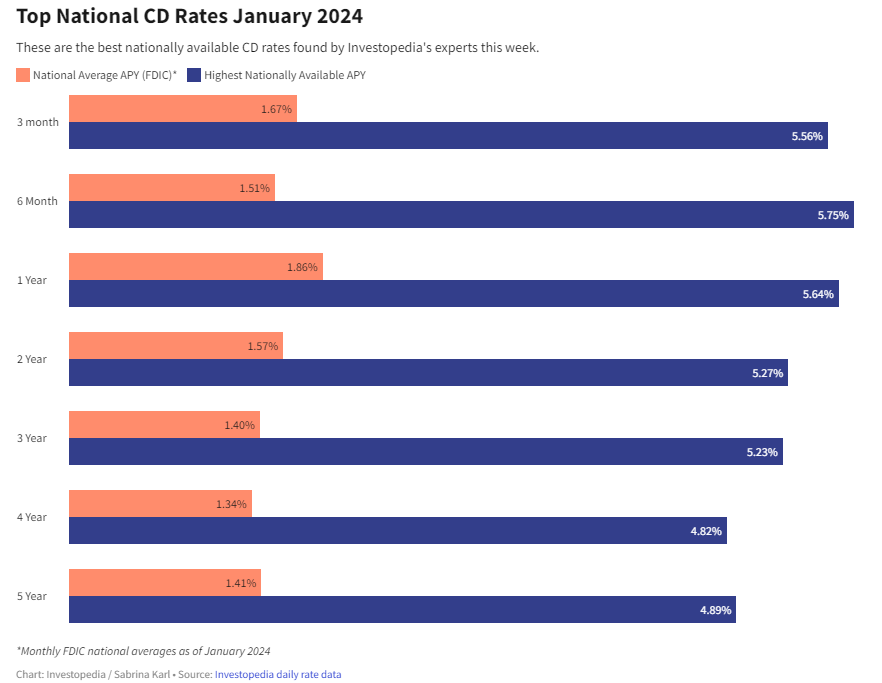

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create