FOREX-Dollar rises before Fed meeting, euro weakens on dismal GDP outlook

The dollar gained some ground against its major peers on Tuesday, as investors awaited the Federal Reserve's monetary policy decision and guidance on Wednesday.

The Fed is widely expected to keep its benchmark interest rate unchanged at near zero, but may signal a faster pace of tapering its bond purchases amid rising inflation and a robust economic recovery.

The dollar index, which measures the greenback against a basket of six currencies, rose 0.2% to 94.32, after hitting a one-month high of 94.44 on Monday.

"The dollar is holding up well ahead of the Fed meeting, as the market is pricing in a more hawkish stance from the central bank," said Masafumi Yamamoto, chief currency strategist at Mizuho Securities in Tokyo. "The Fed may acknowledge the inflation risks and hint at an earlier rate hike next year, which would support the dollar."

The euro fell 0.3% to $1.1315, after touching a one-month low of $1.1304 on Monday. The single currency was weighed down by expectations of weak euro zone GDP data for the fourth quarter, due on Wednesday.

The euro zone economy is forecast to have contracted by 0.4% in the final three months of 2023, as the region faced a surge in COVID-19 cases and renewed lockdowns.

"The euro is under pressure from the divergence in economic performance and monetary policy between the euro zone and the U.S.," said Yukio Ishizuki, senior currency strategist at Daiwa Securities in Tokyo. "The euro zone GDP data may confirm the gloomy outlook for the region, while the U.S. GDP data on Thursday may show a solid expansion."

The U.S. economy is estimated to have grown by 6.7% on an annualized basis in the fourth quarter, according to a Reuters poll of economists.

The British pound was little changed at $1.3480, after hitting a one-month low of $1.3458 on Monday. The pound was supported by hopes of a breakthrough in the talks between the UK and the EU over the Northern Ireland protocol, which has been a source of tension since Brexit.

The Australian dollar slipped 0.1% to $0.7195, after falling to a one-month low of $0.7184 on Monday. The Aussie was hurt by concerns over China's economic slowdown and regulatory crackdown, as well as the domestic COVID-19 situation.

The New Zealand dollar edged up 0.1% to $0.6775, after dropping to a one-month low of $0.6758 on Monday. The kiwi was boosted by upbeat inflation data, which showed that consumer prices rose by 2.9% in the fourth quarter, the highest annual rate since 2011.

The Canadian dollar was steady at 1.2685 per U.S. dollar, after hitting a one-month low of 1.2708 on Monday. The loonie was supported by higher oil prices, which rose above $87 a barrel on Tuesday, as OPEC+ stuck to its plan to gradually increase output.

The Japanese yen was flat at 114.35 per dollar, after reaching a one-month low of 114.56 on Monday. The yen was subdued by expectations of a dovish Bank of Japan policy meeting on Thursday, as well as the political uncertainty ahead of the general election on Sunday.

The Swiss franc was also unchanged at 0.9235 per dollar, after touching a one-month low of 0.9244 on Monday. The franc was weighed down by the risk-on mood in the global markets, as well as the negative interest rate differential with the U.S. dollar.

Profitability and risk management of financial institutions

Profitability and risk management are two key aspects of financial institutions that are closely related and often influenced by various factors, such as regulation, market conditions, competition, innovation, and customer behavior. In this response, I will try to summarize some of the main po

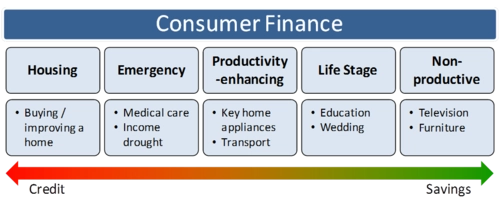

The Impact of Financial Technology on the Consumer Finance Market

Financial technology, or fintech, is the use of digital technology to improve and automate the delivery and use of financial services. Fintech has a significant impact on the consumer finance market, which includes products and services such as credit cards, loans, mortgages, insurance, saving

The Future Development Trends of Internet Finance and Its Impact on Commercial Banks

The future development trends of internet finance and its impact on commercial banks are very important topics for the financial industry and society. Based on the web search results, I can provide you with some general information and insights. Internet finance is an emerging field t

Challenges and Opportunities in Financing

Financing is a crucial aspect of any business, especially for startups and small enterprises that need capital to launch or grow their operations. However, financing also comes with various challenges and opportunities that entrepreneurs and managers need to be aware of and address. Here are s