JPMorgan Breaks US Banking Record with $49.6B Profit in 2023, CEO Warns of Inflation Risks

JPMorgan Chase & Co. (JPM), the largest US bank by assets, reported record-breaking profits for 2023, despite a 15% drop in its fourth-quarter earnings. The bank attributed its strong performance to higher interest income, lower credit costs, and robust fee income from its diverse businesses. However, the bank's CEO Jamie Dimon warned that inflation could be more persistent than expected and interest rates could be higher for longer, posing challenges for the economy and the financial sector.

JPMorgan's net income for 2023 rose 32% to $49.6 billion, the highest in US banking history, surpassing its previous record of $48.3 billion in 2021. The bank's earnings per share for 2023 increased 35% to $16.54, beating the analyst consensus of $16.29. The bank's revenue for 2023 grew 9% to $122.9 billion, also exceeding the analyst estimate of $121.8 billion.

The bank's net interest income, which reflects the difference between what it earns from loans and pays on deposits, surged 34% to $89.7 billion in 2023, driven by higher interest rates and loan growth. The bank's noninterest income, which includes fees from investment banking, trading, asset management, and card services, rose 2% to $33.2 billion in 2023, supported by strong client activity and market conditions.

The bank's credit quality improved significantly in 2023, as the bank released $8.6 billion of loan loss reserves that it had set aside during the COVID-19 pandemic. The bank's provision for credit losses, which reflects the amount of money it expects to lose from bad loans, was a net benefit of $4.2 billion in 2023, compared to a net expense of $12.2 billion in 2022. The bank's net charge-offs, which reflect the amount of loans that it actually wrote off as uncollectible, declined 31% to $3.4 billion in 2023.

The bank's expenses increased 11% to $67.1 billion in 2023, mainly due to higher compensation, technology, and legal costs. The bank's efficiency ratio, which measures how well it manages its expenses relative to its revenue, worsened to 55% in 2023, from 53% in 2022. The bank's return on equity, which measures how well it generates profits from its shareholders' capital, improved to 18% in 2023, from 15% in 2022.

The bank's fourth-quarter net income fell 15% to $9.3 billion, or $3.04 per share, from $11 billion, or $3.57 per share, in the same period of 2022. The bank's fourth-quarter earnings were impacted by a $2.9 billion charge related to a special assessment by the Federal Deposit Insurance Corporation (FDIC) on the failure of Silicon Valley Bank and other financial institutions in 2023. Excluding this charge and other one-time items, the bank's adjusted earnings per share for the fourth quarter were $3.97, beating the analyst consensus of $3.35. The bank's revenue for the fourth quarter rose 12% to $38.6 billion, also surpassing the analyst estimate of $39.7 billion.

The bank's CEO Jamie Dimon expressed optimism about the US economy, which he said was resilient and growing, despite the challenges posed by the Omicron variant of COVID-19. He said the bank was well-positioned to serve its customers and clients, and to capture growth opportunities across its businesses. He also said the bank was committed to investing in its people, technology, and communities, and to creating long-term value for its shareholders.

However, Dimon also cautioned that inflation could be more persistent and interest rates could be higher than expected, due to the large amounts of government spending and stimulus that have fueled the economic recovery. He said this could lead to higher costs, lower margins, and lower valuations for the bank and the financial sector. He also said the bank was facing geopolitical risks, such as the conflicts in Ukraine and the Middle East, which could disrupt the global economy and markets.

JPMorgan's stock price closed at $157.86 on Friday, January 8, 2024, down 0.7% from the previous day. The stock price has increased 27.8% in the past year, outperforming the S&P 500 index, which has gained 9.4% in the same period. The stock price has also been supported by the bank's dividend and share buyback programs, which have returned $40.3 billion to shareholders in 2023.

Analysts are generally bullish on JPMorgan's prospects, citing its diversified and resilient business model, its strong balance sheet and capital position, and its growth potential and competitive advantage in the financial sector. According to FactSet, the average analyst rating for JPMorgan is "buy", and the average target price is $186.86, implying a 18.4% upside from the current price.

Profitability and risk management of financial institutions

Profitability and risk management are two key aspects of financial institutions that are closely related and often influenced by various factors, such as regulation, market conditions, competition, innovation, and customer behavior. In this response, I will try to summarize some of the main po

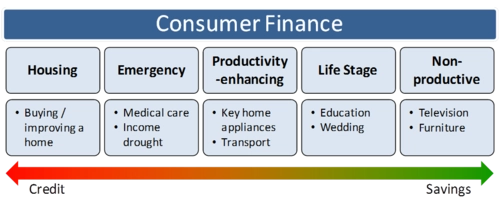

The Impact of Financial Technology on the Consumer Finance Market

Financial technology, or fintech, is the use of digital technology to improve and automate the delivery and use of financial services. Fintech has a significant impact on the consumer finance market, which includes products and services such as credit cards, loans, mortgages, insurance, saving

The Future Development Trends of Internet Finance and Its Impact on Commercial Banks

The future development trends of internet finance and its impact on commercial banks are very important topics for the financial industry and society. Based on the web search results, I can provide you with some general information and insights. Internet finance is an emerging field t

Challenges and Opportunities in Financing

Financing is a crucial aspect of any business, especially for startups and small enterprises that need capital to launch or grow their operations. However, financing also comes with various challenges and opportunities that entrepreneurs and managers need to be aware of and address. Here are s