Credit Risk Modelling: An Essential Tool for Financial Institutions

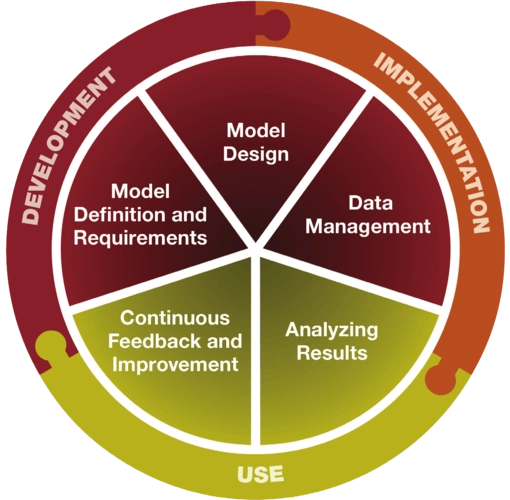

Credit risk modelling is a crucial aspect of the financial industry. It is a process that enables financial institutions to assess the creditworthiness of their customers and determine the likelihood of default. This information is then used to make informed decisions about lending, investment, and risk management. In this article, we will explore the importance of credit risk modelling, its benefits, and the different types of models used in the financial industry.

Why is Credit Risk Modelling Important?

Credit risk modelling is essential for financial institutions as it helps them to manage their credit risk exposure. By understanding the creditworthiness of their customers, financial institutions can make informed decisions about lending and investment. This reduces the risk of default and helps to maintain the financial stability of the institution.

Furthermore, credit risk modelling is also important from a regulatory perspective. Many regulatory bodies require financial institutions to have a robust credit risk management framework in place. This includes the use of credit risk models to assess the creditworthiness of their customers.

Benefits of Credit Risk Modelling

The benefits of credit risk modelling are numerous. Firstly, it enables financial institutions to make informed decisions about lending and investment. This reduces the risk of default and helps to maintain the financial stability of the institution.

Secondly, credit risk modelling provides a framework for risk management. Financial institutions can use this information to develop strategies to mitigate credit risk exposure. This includes setting appropriate credit limits, monitoring credit quality, and developing contingency plans in case of default.

Thirdly, credit risk modelling can help to improve profitability. By understanding the creditworthiness of their customers, financial institutions can identify profitable lending opportunities while minimizing the risk of default.

Types of Credit Risk Models

There are various types of credit risk models used in the financial industry. These include:

1. Probability of Default (PD) Models: These models estimate the likelihood of default for a given borrower or portfolio.

2. Loss Given Default (LGD) Models: These models estimate the potential loss that may occur if a borrower defaults.

3. Exposure at Default (EAD) Models: These models estimate the exposure that a financial institution has to a borrower at the time of default.

4. Stress Testing Models: These models assess the impact of adverse economic scenarios on a financial institution's credit risk exposure.

Credit risk modelling is an essential tool for financial institutions. It enables them to assess the creditworthiness of their customers, make informed decisions about lending and investment, and manage their credit risk exposure. The benefits of credit risk modelling include improved profitability, reduced risk of default, and a framework for risk management. Financial institutions use various types of credit risk models, including Probability of Default (PD) Models, Loss Given Default (LGD) Models, Exposure at Default (EAD) Models, and Stress Testing Models. By using these models, financial institutions can maintain their financial stability while providing valuable services to their customers.

Profitability and risk management of financial institutions

Profitability and risk management are two key aspects of financial institutions that are closely related and often influenced by various factors, such as regulation, market conditions, competition, innovation, and customer behavior. In this response, I will try to summarize some of the main po

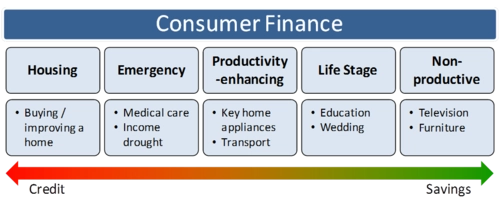

The Impact of Financial Technology on the Consumer Finance Market

Financial technology, or fintech, is the use of digital technology to improve and automate the delivery and use of financial services. Fintech has a significant impact on the consumer finance market, which includes products and services such as credit cards, loans, mortgages, insurance, saving

The Future Development Trends of Internet Finance and Its Impact on Commercial Banks

The future development trends of internet finance and its impact on commercial banks are very important topics for the financial industry and society. Based on the web search results, I can provide you with some general information and insights. Internet finance is an emerging field t

Challenges and Opportunities in Financing

Financing is a crucial aspect of any business, especially for startups and small enterprises that need capital to launch or grow their operations. However, financing also comes with various challenges and opportunities that entrepreneurs and managers need to be aware of and address. Here are s