Profit & Loss Statement

A profit and loss statement, also known as an income statement or P&L statement, is a financial document that provides a summary of a company's revenues, costs, and expenses during a specific period of time. It is an essential tool for businesses to assess their financial performance and determine their profitability.

The profit and loss statement starts with the company's total revenues, which include all the income generated from its primary operations. This can include sales of products or services, as well as any other sources of revenue such as interest or rental income. The revenues are then subtracted by any discounts or returns to arrive at the net revenue.

Next, the statement deducts the cost of goods sold (COGS), which includes all the direct costs associated with producing or delivering the company's products or services. This can include the cost of raw materials, direct labor, and any other expenses directly related to production. The difference between net revenue and COGS is known as the gross profit.

After deducting the COGS, the profit and loss statement lists the operating expenses. These are the costs incurred by the company in its day-to-day operations, such as rent, utilities, salaries, marketing expenses, and administrative costs. The total of these expenses is subtracted from the gross profit to arrive at the operating profit.

In addition to operating expenses, the profit and loss statement may also include other income or expenses that are not directly related to the company's core operations. This can include gains or losses from the sale of assets, interest income or expenses, and any other non-operating income or expenses. These items are typically listed separately and added or subtracted from the operating profit to arrive at the net profit before taxes.

Finally, the profit and loss statement deducts any taxes owed by the company to arrive at the net profit after taxes. This is the final figure that represents the company's bottom line profitability. It is important to note that this figure does not take into account any dividends or distributions made to shareholders.

The profit and loss statement is a valuable tool for businesses of all sizes and industries. It provides a clear picture of a company's financial performance and helps management make informed decisions about pricing, cost control, and overall business strategy. Investors and lenders also rely on the profit and loss statement to assess a company's profitability and financial health.

A profit and loss statement is an essential financial document that summarizes a company's revenues, costs, and expenses during a specific period of time. It provides valuable insights into a company's financial performance and helps stakeholders make informed decisions. By analyzing the information presented in a profit and loss statement, businesses can identify areas for improvement and take steps to enhance their profitability.

Profitability and risk management of financial institutions

Profitability and risk management are two key aspects of financial institutions that are closely related and often influenced by various factors, such as regulation, market conditions, competition, innovation, and customer behavior. In this response, I will try to summarize some of the main po

The Impact of Financial Technology on the Consumer Finance Market

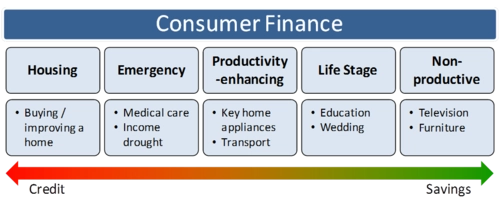

Financial technology, or fintech, is the use of digital technology to improve and automate the delivery and use of financial services. Fintech has a significant impact on the consumer finance market, which includes products and services such as credit cards, loans, mortgages, insurance, saving

The Future Development Trends of Internet Finance and Its Impact on Commercial Banks

The future development trends of internet finance and its impact on commercial banks are very important topics for the financial industry and society. Based on the web search results, I can provide you with some general information and insights. Internet finance is an emerging field t

Challenges and Opportunities in Financing

Financing is a crucial aspect of any business, especially for startups and small enterprises that need capital to launch or grow their operations. However, financing also comes with various challenges and opportunities that entrepreneurs and managers need to be aware of and address. Here are s