The Development and Risk Management of Financial Options Market

The development and risk management of financial options market is a complex and dynamic topic that involves various aspects, such as the role and strategies of market makers, the measurement and management of market risk, the impact of exchange rate regimes, and the regulation and supervision of financial markets. Here are some web search results that provide more information on this topic:

Market making and risk management in options markets: This article examines the personal trading strategies of member proprietary traders in the natural gas futures options market. It analyzes how they manage their inventory holding, rebalancing, and volatility risk exposures, and how they are influenced by inflation, fiscal deficits, foreign exchange reserves, and capital controls.

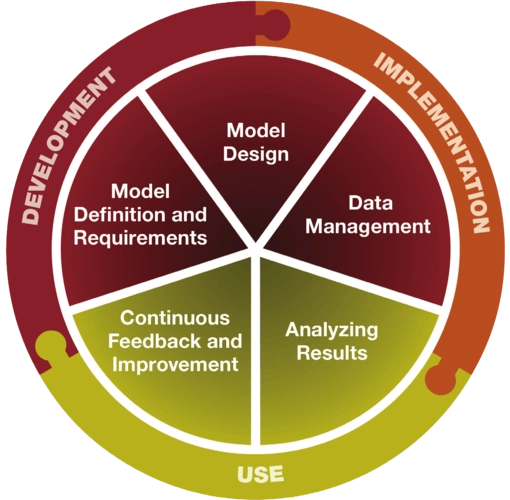

Measuring and Managing Market Risk: This article provides an overview of the process of measuring and managing market risk, which is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. It discusses the concept and methods of value at risk, and the advantages and limitations of different approaches to estimating value at risk.

Market Risk and Financial Markets Modeling: This book explores the flaws and challenges of models, measures and theories that failed to provide forward-looking expectations for upcoming losses originated from market risks. It covers topics such as market microstructure, volatility modeling, extreme value theory, and systemic risk.

Emerging Trends in FX Options Trading and Risk Management: This article discusses some of the headwinds facing FX option traders, such as low volatility, regulatory changes, and market fragmentation. It also suggests how expanding their repertoire to include both OTC and listed products can help overcome those challenges and capture new opportunities.

Financial Regulation and Risk Management in Development Banks: This book examines the role and challenges of development banks in promoting financial inclusion and sustainable development. It analyzes the evolution and impact of the Basel Agreements framework, and the risk management practices and regulatory policies of development banks.

Profitability and risk management of financial institutions

Profitability and risk management are two key aspects of financial institutions that are closely related and often influenced by various factors, such as regulation, market conditions, competition, innovation, and customer behavior. In this response, I will try to summarize some of the main po

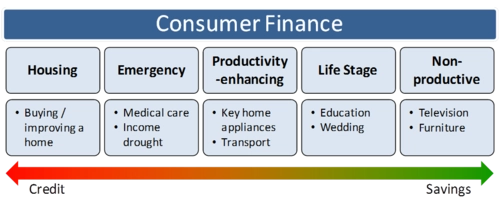

The Impact of Financial Technology on the Consumer Finance Market

Financial technology, or fintech, is the use of digital technology to improve and automate the delivery and use of financial services. Fintech has a significant impact on the consumer finance market, which includes products and services such as credit cards, loans, mortgages, insurance, saving

The Future Development Trends of Internet Finance and Its Impact on Commercial Banks

The future development trends of internet finance and its impact on commercial banks are very important topics for the financial industry and society. Based on the web search results, I can provide you with some general information and insights. Internet finance is an emerging field t

Challenges and Opportunities in Financing

Financing is a crucial aspect of any business, especially for startups and small enterprises that need capital to launch or grow their operations. However, financing also comes with various challenges and opportunities that entrepreneurs and managers need to be aware of and address. Here are s