Trends and Challenges in the US Real Estate Market

The U.S. real estate market is facing various trends and challenges in 2023, according to different sources. Some of the main ones are:

The pandemic has created a bifurcated office market, with high demand for flexible and hybrid workspaces, but low demand for traditional and long-term leases. This has led to a divergence in vacancy rates, rents, and valuations between different types of office properties.

The U.S. economy is expected to slow down in 2023, as the Fed raises interest rates to combat inflation and fiscal stimulus fades. This could trigger a recession by late 2023 or early 2024, affecting the demand and supply of real estate across all sectors.

Interest rate uncertainty is still a barrier to deal activity, as investors are cautious about the timing and magnitude of rate hikes. Higher borrowing costs could also reduce the profitability and attractiveness of real estate investments.

Climate risk is growing, as the frequency and severity of natural disasters increase due to global warming. This poses a threat to the physical and financial performance of real estate assets, as well as the health and safety of occupants. Real estate players need to adopt more sustainable practices and technologies to mitigate the environmental and social impacts of their operations.

Higher interest rates could impact housing affordability, as mortgage payments become more expensive for homebuyers. This could dampen the demand for homeownership and increase the demand for rental housing, especially in affordable and workforce segments1. However, the supply of multifamily housing is still lagging behind the demand, creating a shortage of units and upward pressure on rents.

Profitability and risk management of financial institutions

Profitability and risk management are two key aspects of financial institutions that are closely related and often influenced by various factors, such as regulation, market conditions, competition, innovation, and customer behavior. In this response, I will try to summarize some of the main po

The Impact of Financial Technology on the Consumer Finance Market

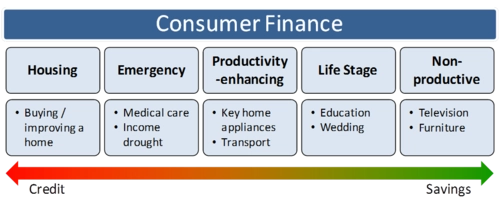

Financial technology, or fintech, is the use of digital technology to improve and automate the delivery and use of financial services. Fintech has a significant impact on the consumer finance market, which includes products and services such as credit cards, loans, mortgages, insurance, saving

The Future Development Trends of Internet Finance and Its Impact on Commercial Banks

The future development trends of internet finance and its impact on commercial banks are very important topics for the financial industry and society. Based on the web search results, I can provide you with some general information and insights. Internet finance is an emerging field t

Challenges and Opportunities in Financing

Financing is a crucial aspect of any business, especially for startups and small enterprises that need capital to launch or grow their operations. However, financing also comes with various challenges and opportunities that entrepreneurs and managers need to be aware of and address. Here are s