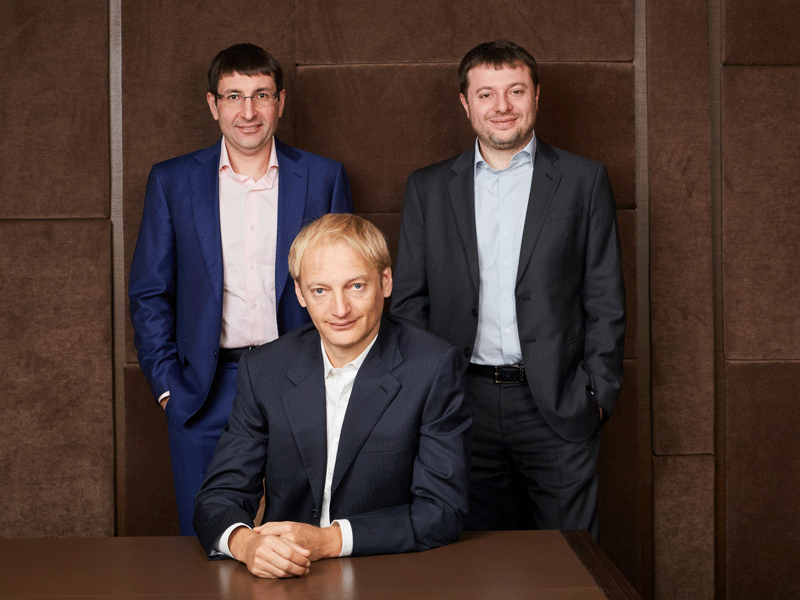

It is remarkable that while countless entities in Russia have struggled during these tumultuous times, Sovcombank did more than just survive: it thrived. This success is rooted in the bank’s far-sighted approach to banking. “We always try to manage the business in a countercyclical way, which means that during good times, we keep our capital base and liquidity in a safer mode than most of our privately owned competitors,” Khotimskiy told

World Finance

. “This means that when bad times come, we always have a cushion in place.”

In fact, the bank was able to utilise a variety of opportunities that it recognised during both the 2008 crash and the Russian economic crisis of 2014. “During these periods of time, we managed to buy very attractive assets and secure very attractive clients. So we actually made more money and were more successful after those crises than ever before,” Khotimskiy noted.

“This strategy works very well in Russia and we think it will continue working in the future because the economy is very volatile, and whenever people are scared about what’s going on in Russia’s economy, there are amazing opportunities to be found,” he continued. “Russia has proved again and again that it can survive external shocks, and in every shock there is an opportunity.”

A foreign exodus

Given the precarious economic landscape after 2008, a number of foreign banks have gradually reduced their investments in Russia. According to outlets in the Russian media, the total loss amounts to around $2bn.

Khotimskiy explained the reasons behind this shift: “I think it’s very challenging for a foreign institution to be successful in Russia right now. I think those institutions that are still here are very successful and Russia plays quite a significant role in their global balance sheets. They are Italian, Austrian and French banks; even Citibank is very successful in Russia. But I think for newcomers right now, the political situation is not very favourable. I also think the fact that we saw a significant exodus of different foreign banks proves that even though some champions remain, in general, the environment is very tricky.”

While this environment has closed off various opportunities for foreign banks, it has opened many new doors for domestic institutions. That said, Russia’s prospects for foreign portfolio investment remain very attractive. Khotimskiy told

World Finance

: “I think Russia is a darling for portfolio investors because of its volatility. For those professionals that understand Russia well enough, I think Russia always proves to be a land of opportunities. Because when everyone becomes scared and a huge sell-off is on the way, you can always make great use of that.”

Clean-up time

Against this complex backdrop, another momentous shift has been underway. Indeed, the past five years have been nothing short of decisive for Russia’s financial sector. Under the leadership of Elvira Nabiullina, who was appointed as the new head of the CBR midway through 2013, a large-scale and unprecedented clean-up of the industry has taken place.

For those professionals that understand Russia, I think it always proves to be a land of opportunities

When Nabiullina took to the helm of the CBR, she was faced with an ailing and bloated banking sector. In the 2000s, a booming oil sector helped mask the problems facing Russia’s banks, but the 2008 crisis swiftly brought them to the surface. Of greatest concern were deficient regulations, the prevalence of bad loans and a lack of capital. Fortunately, under Nabiullina, the CBR has deepened oversight in the sector by enforcing more robust liquidity and capital adequacy requirements.

In the early stages of the initiative, the CBR focused on curtailing suspicious capital outflows, under the belief that billions upon billions have left the country, and purging so-called ‘pocket banks’. The post-soviet term refers to institutions created by industrial groups to service their businesses’ financial needs; in some cases they also acted as fronts for money laundering. The CBR took on banks that were previously considered untouchable, gradually tightening rules along the way, including those related to lending to the banks’ owners.

Five years later, Russia’s clean-up of its banks is more than half complete: from more than 900 banks in 2013, around 500 are left today. While some have collapsed, others were bailed out by the state. The biggest among these were B&N Bank, Otkritie, and Promsvyazbank, which were all seized by the CBR in 2017.

Meanwhile, since mid-2017, only financial institutions with strong ratings from Russian ratings agencies ACRA and Expert RA have been entitled to state funds and instruments. Another new rule – though only for the interim – involves meeting capital requirements and having balance sheets of a certain size in order to access state funds.

The CBR’s robust work is lauded for having prevented another financial crisis, while helping to strengthen healthy banks in its wake. “Sovcombank is one of the beneficiaries of this process, because we were always suffering from the competition of organisations that never really bothered to stick to the rules, as well as those that were under-capitalised and managed to grow without a real capital base,” said Khotimskiy.

“From this point of view, the clean-up is very important: it’s clear that there are no significantly big privately owned banks that can work the way they used to before. So we think that the job done by the central bank is really a base for both significant economic growth and the healthy growth of the banking system in the future.”

Consequently, in recent years, the Russian banking sector has been showing impressive figures in terms of returns on capital and assets. “Obviously, because inflation rates are low, the returns that we used to see are no longer on the table,” Sergey Khotimskiy explained. “However, at the same time, Russia still has one of the highest equity returns on assets in the world, so I think that we’ll be seeing double-digit returns in most banks. As far as Sovcombank is concerned, for the last 10 years, our average ROE was more than 30 percent, and we expect it to stay above 20 percent for the next three to five years.”

The march of technology

The future for Russia’s banking sector looks promising – an outlook that is strengthened further by its impressive adoption of cutting-edge financial technology. Unlike other markets, however, this drive is not led by fintech players: according to Gusev, it actually comes from the banks themselves.

The past five years have been nothing short of decisive for Russia’s financial sector

“The Russian banking system is a unique financial system in this sense. The general state of Russian banking is very developed in terms of technology, and I think some champions – both state and privately owned – really are the key drivers of the digitalisation of financial

systems,” Gusev noted.

Over the past year or so, many successful fintech start-ups in Russia have been acquired and integrated into domestic financial institutions. Gusev said: “We think that’s because very strong banks are paying huge attention to digitalisation; I think this trend is probably going to stay the same for some time. While many fintech companies will be at various stages, the most advanced ones will continue to be bought out by the banks themselves.”

Speaking about some of the most exciting technology the market has to offer, Gusev was clear about what stands out for him at present: remote biometric identification (RBI) and Russia’s Unified Biometric System (UBS).

“We live in the digital age, and we can hardly imagine our everyday lives without mobile devices,” Gusev said. “We are regular users of mobile communication, and at the same time we still can’t fully function without offline visits to a bank office; without physical identification on the spot. In my opinion, this is a relic that should be addressed as soon as possible.”

This is where RBI and UBS come in, as they allow banks to identify clients remotely, thereby eliminating the need for their physical presence in brick-and-mortar bank branches. “I think this is a game-changer for the industry, and in several years, we will see more and more bank branches shut down,” Gusev told

World Finance

. “Only those banks that manage to turn their outlets into centres for consulting and for sales without any operational work will be really successful in reaching out to their clients in remote locations, and even in big cities.”

Sovcombank was one of the first credit institutions in Russia that began to gather the biometric data of its customers and transfer them to the UBS. “Of course, we can’t say that the system is working flawlessly at present, or that there are no problems with data transmission, but this can be expected because the process is still in its very early stages,” said Gusev.

He continued: “As for the advantages, it should be understood that this issue can’t be considered only in the banking context – in the future, we are thinking about creating a universal digital profile of the client, which they can use to obtain services in the bank and to solve a much wider range of problems and tasks. This point, in my opinion, should be explained to our customers, as the question of the speed of filling the UBS is not only a question of the activity of banking organisations, but also a question of the financial literacy of users.”

Aside from RBI, Gusev notes that the other technologies set to transform the industry include the introduction of a system of fast payments, application programming interfaces and technology based on a distributed registry system. Gusev said: “The fifth is, of course, end-to-end protocol, which allows you to combine different databases, and on this basis, to create a universal digital client profile. All of these technologies are interconnected in one way or another, and complement each other. They have all arisen due to the fact that the very philosophy of human life has changed. Indeed, we are increasingly entering the age of the digital economy, and this is changing our perception of the most mundane things, including banking and financial services.”

As the industry hangs on the cusp of this new future, some retrospection is important. Undoubtedly, a great deal has happened in Russia’s financial sector over the past decade – the last five years, especially so. This transformation can be attributed to a variety of factors, from a series of drastic external shocks to a dramatic clean-up of the industry. As the CBR’s initiative continues, more robust regulations will be implemented, while the unhealthiest banks will be removed from the landscape. Interestingly, this is not the only ongoing factor at play: the industry is being shaped further by new technology and the new opportunities that it presents.

Sovcombank is well positioned to capture both. As demonstrated by its track record, the bank rarely fails to notice the opportunities that can be found, even in the most difficult of circumstances. All the while, it stays ahead of the curve, never resting on its laurels, working countercyclically and adopting the latest innovations in the industry to stay profitable, while remaining a key partner to its clients, both big and small. Russia’s financial industry has faced an incredible onslaught of challenges in recent years, but out of the clouds of doubt, the likes of Sovcombank continue to shine through.

post-navigation" role="navigation" aria-label="Posts">

With Sovcombank’s cost of risk being among the lowest in the country, its expansion soon took place: starting life as a single office in Buoy, today the bank’s retail segment has over 2,000 offices in more than 1,000 towns across Russia, serving some 3.2 million customers.

With Sovcombank’s cost of risk being among the lowest in the country, its expansion soon took place: starting life as a single office in Buoy, today the bank’s retail segment has over 2,000 offices in more than 1,000 towns across Russia, serving some 3.2 million customers.

However, as Gusev explained, many banks were not completely capitalised during that period, meaning they did not have a capital base in place to fully support growth. Sovcombank, on the other hand, maintained a prudent approach and expanded with the pace of its new profit generating capacity. It is through this strategy that Sovcombank has since established itself as one of the biggest privately owned banks in Russia.

However, as Gusev explained, many banks were not completely capitalised during that period, meaning they did not have a capital base in place to fully support growth. Sovcombank, on the other hand, maintained a prudent approach and expanded with the pace of its new profit generating capacity. It is through this strategy that Sovcombank has since established itself as one of the biggest privately owned banks in Russia.