On thin ice: thawing permafrost dampens Russia’s economic growth prospects

There are many reasons why one might decide against buying a house in the Siberian city of Norilsk: the Sun doesn’t rise for three months each year; the name of the neighbouring town translates as either ‘forbidden place’ or ‘death valley’; and it’s so cold that the bodies of the Gulag prisoners who built it are said to be perfectly preserved beneath a memorial at the foot of Mount Schmidtikha.

It’s fair to say that it’s no place for the faint-hearted. At the very least, buying a house in such a dark, icy wasteland should be good value for money, but even this is no longer the case. “The population of the city used to be 300,000, give or take,” Nikolay Shiklomanov, Associate Professor of Geography and International Affairs at the George Washington University, told World Finance. “Nowadays, it’s 180,000… so you would expect that the housing market should be pretty light – that there should be lots of empty spaces – but now they’re experiencing some acute housing shortages because so many of the buildings there are critically deformed.”

Norilsk is the largest city in the world to be built on permafrost – ground with a temperature that remains at or below freezing point for more than two years. Now, as the Earth’s climate warms, that permafrost is melting. In fact,

While GDP and employment in petrostates such as Saudi Arabia revolve around oil and gas revenue, Russia has a relatively diversified economy Warming to the idea Alexander Krutikov, Deputy Minister for the Development of the Russian Far East and Arctic,

Until recently, President Vladimir Putin argued that global warming was good news for Russia. At the 2017 Arctic: Territory of Dialogue international forum, he

But this year, the leader of the world’s fourth-largest greenhouse gas emitter changed his tune on climate change. Although Putin continues to insist the phenomenon can’t be confidently attributed to human activity, he

According to Shiklomanov, global warming could affect as much as a fifth of infrastructure across the permafrost area by 2050, costing Russia approximately $84bn, or 7.5 percent of its GDP. As the tundra melts, underground methane is released, causing gas pipelines to explode. At the same time, Russia’s shoreline is

Russia’s coast currently witnesses an accident involving power stations, nuclear-powered icebreakers, chemical facilities or communications installations every three months. Needless to say, Putin’s new stance on global warming is a huge paradox: by curbing greenhouse gas emissions, he hopes to keep feeding and expanding an emissions-producing oil and gas industry. As the leader of the world’s second-largest oil exporter (see Fig 1), though, this position makes a certain amount of sense – arguably, the sector is simply too important for Russia to lose. Greasing the wheels While GDP and employment in petrostates such as Saudi Arabia revolve around oil and gas revenue, Russia has a relatively diversified economy. For example, the services sector makes up a larger share of Russia’s GDP than oil and gas (see Fig 2). Nonetheless, oil and gas revenues are still crucially linked to the non-oil economy in Russia, accounting for 40 percent of government income, according to the International Renewable Energy Agency (IRENA). The wealth generated by oil and gas – known as oil and gas rents – is extracted by the state and channelled into strategically important sectors or the economy more broadly, either in the form of taxes paid to the government or as subsidies for other goods and services. This system, however, means Russia can only prosper so long as oil prices are high. As such, its economy is extremely vulnerable to sudden changes in oil demand and supply. “If you go back to the 1980s, one of the factors that led to the eventual collapse of the Soviet economy was the fall in oil and gas prices and the loss of substantial rent to the economy,” Bradshaw told World Finance. “That volatility, of course, continued through the 1990s and 2000s, at times supporting the Russian economy and at times punishing it.” One obvious way of reducing Russia’s exposure to oil shocks is through economic diversification, but such reform is made difficult by the fact that non-oil sectors are so heavily reliant on oil and gas rents. Moreover, beneficiaries of this system are reluctant to change the status quo. “Russia has been spectacularly unsuccessful in seeking to diversify its economy,” Bradshaw explained. “There’s been an awful lot of rhetoric, particularly under [Dmitry] Medvedev’s presidency, but very little change.” To maintain government income in the short term, Russia has to keep expanding oil and gas production. Currently, the need to do so is urgent. Russia’s main oil and gas fields are depleting: according to the

A pipe dream Russia is convinced that its economic future depends on Arctic exploration. As well as opening up a globally important shipping route, the melting sea ice makes it easier to access rich supplies of fossil fuels. The

But extracting oil and gas in such a hostile environment with limited infrastructure is far from easy. “These are very capital-intensive areas where returns are not expected before 10 to 20 years of development,” Pami Aalto, a Jean Monnet professor at the University of Tampere, told World Finance. Consequently, oil and gas companies have to make large investments up front to carry out production, meaning they are often dependent on both government subsidies and foreign technology. In this regard, Russia has faced some major setbacks. EU and US sanctions – imposed after Russia’s annexation of Crimea – limit the country’s ability to secure funding for new oil projects and import the hi-tech equipment needed for Arctic exploration. As Aalto points out, this presents a significant hurdle to Russia’s Arctic oil ambitions: “It is not feasible to explore, extract and develop much without international partners. In the Arctic, 80 to 90 percent of technology has been foreign, compared to 40 to 50 percent elsewhere in Russia before import substitution policies started big-time in 2014… Russian actors have been forced to [borrow] old equipment from Asia, and it is not in plentiful supply.” At the same time, Moscow is struggling to provide the necessary subsidies as a result of budgetary constraints. According to the

Frozen in time Infrastructure can be adapted to help reduce thawing, but this is expensive, particularly when done at scale

The unenviable situation Norilsk finds itself in is not a unique one within Russia. More than half of Russia’s entire territory is covered by permafrost. As this ground thaws, it’s not just buildings that are in danger, but also pipelines and other oil and gas infrastructure vital to Russia’s economy.

Russia is sometimes referred to as a petrostate, but as analysts like Michael Bradshaw – a professor of global energy at Warwick Business School – point out, this obscures the specific and complex role that oil plays in the Russian economy: “Russia has a fairly substantial economy that is not resource-based. However, it’s increasingly clear that large sectors of the industrial economy are tied one way or another to the resource economy.”

As the Arctic sea ice retreats, the Northern Sea Route becomes more navigable to the world’s superpowers. With a fifth of its territory inside the Arctic Circle, Russia has long envisioned itself as the gatekeeper of this sea lane. Although the Northern Sea Route will never be as integral to global trade as the Suez Canal, it could nonetheless become an important passageway between Europe and Asia,

Economic activity in Russia’s Arctic territory accelerated under former Soviet Union General Secretary Joseph Stalin, who believed that Russia could achieve economic independence from the West by industrialising the resource-rich North. As these settlements grew, Siberia became the crowning glory of Soviet Russia – the communist state had tamed the frozen wastelands, creating economic powerhouses in a region where free marketeers would never have dared venture.

Navigating Economic Challenges: The Journey of India’s Finance Minister, Nirmala Sitharaman

In the face of ongoing economic challenges, India’s Finance Minister, Nirmala Sitharaman, finds herself under increasing pressure. Sitharaman, who made history in 2019 as India’s first full-time female finance minister, is tasked with steering the country towards its economic potential. However, t

Zenith Bank: Leading the Way in ESG Policies

Zenith Bank, a prominent financial institution, is making remarkable progress in aligning its operations with Environmental, Social, and Governance (ESG) policies. The bank has seamlessly integrated sustainable practices into its business model and is committed to adhering to environmentally friendl

Inflation: A Double-Edged Sword

Inflation, a term that often stirs up concern among individuals and policymakers alike, can be a double-edged sword. It can play the role of both a friend and a foe, depending on the circumstances.On one hand, inflation can be a friend, indicative of a robust economy. It can be particularly be

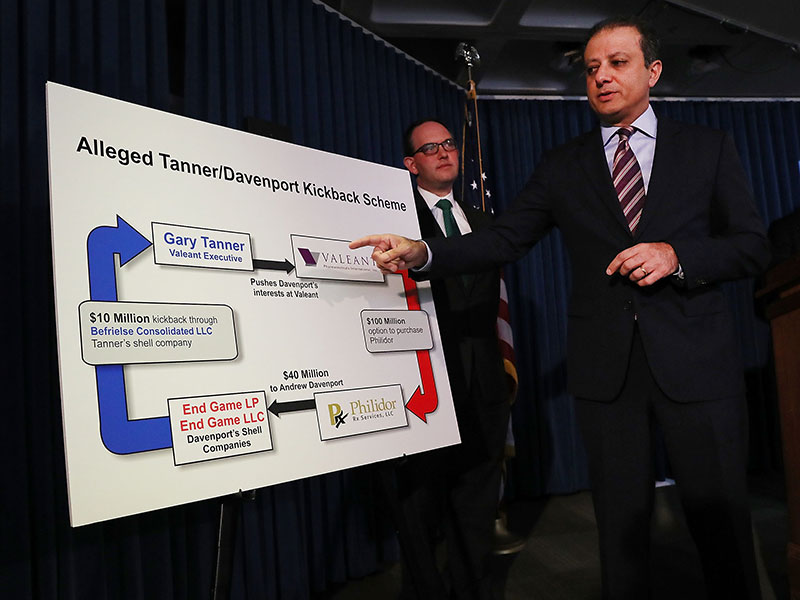

Unveiling Corporate Fraud: The Valeant-Philidor Scandal

Preet Bharara, US attorney for the Southern District of New York, discusses the charges being faced by two former pharmaceutical executives for their participation in an illegal kickback schemeMarkets...