Sterling rises after best week in a year as dollar slide continues

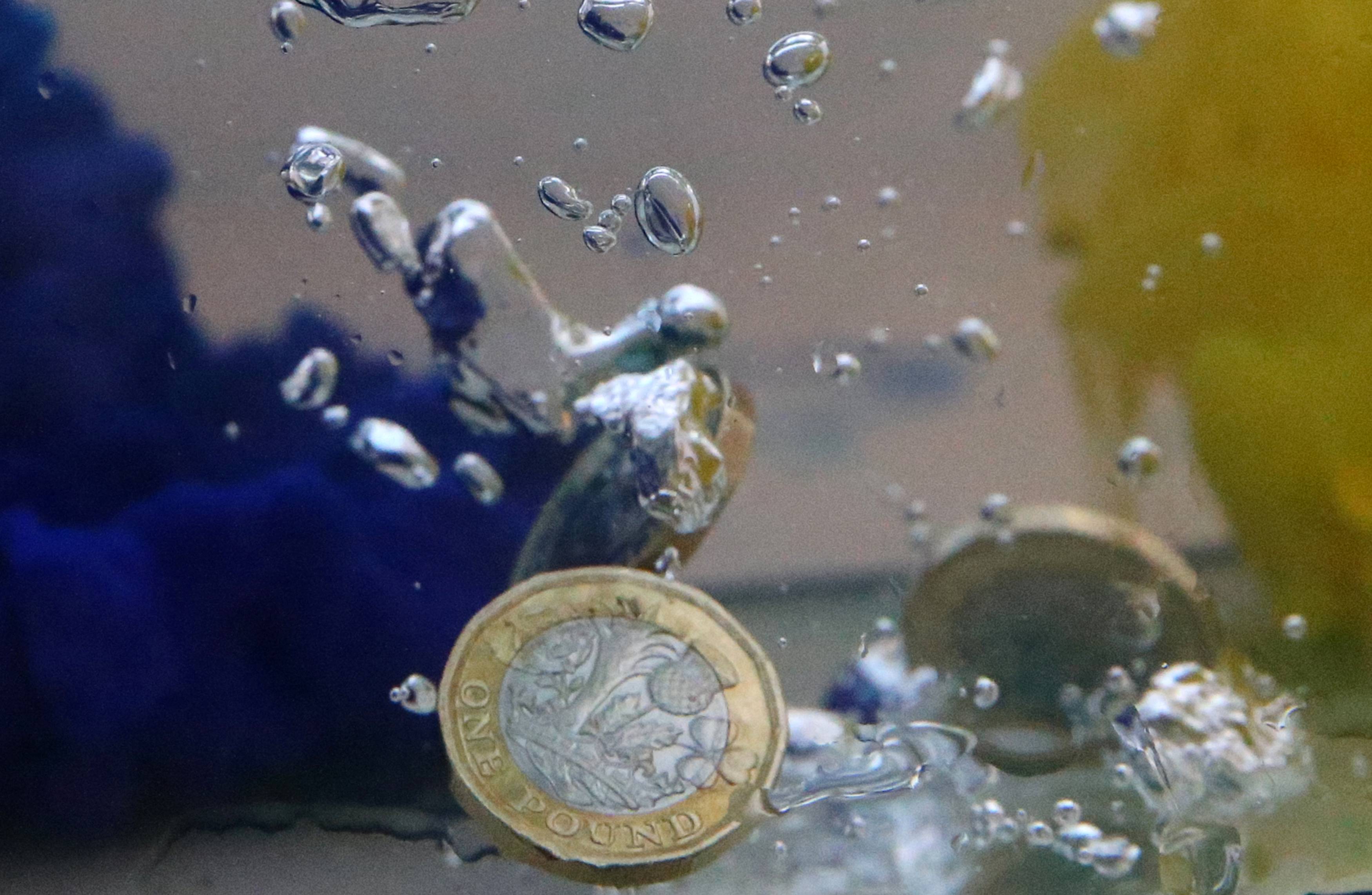

UK pound coins plunge into water coloured with the European Union flag colours in this illustration picture, October 26, 2017. Picture taken October 26, 2017. REUTERS/Dado Ruvic/File Photo Acquire Licensing Rights

LONDON, Nov 6 (Reuters) - The pound rose on Monday, extending the previous week's rally, as a slide in U.S. bond yields continued to weigh on the dollar.

Sterling was last up 0.23% at $1.2409, trading at its highest in more than a month after posting its best weekly performance in a year last week with a rise of 2.1%.

The U.S. dollar index , which tracks the greenback against other major currencies, dropped 1.4% last week after the Federal Reserve held interest rates steady and economic data suggested the U.S. economy might finally be slowing. The index eased a further 0.13% on Monday.

Sterling was slightly stronger against the euro, with the single currency down 0.1% at 86.62 pence.

"It's mostly a dollar story," said Francesco Pesole, FX strategist at ING, adding that the real question is whether the U.S. currency can continue its downtrend.

"We need to see consistent softening in U.S. data and I'm not sure this will happen... We think we might see a little bit of a rebound in the dollar in the next couple of weeks."

Sterling pared gains, however, after survey data showed the UK construction sector suffered a second month of contraction in October as higher borrowing costs hit house-builders.

A survey based gauge of the broader economy, including services and manufacturing, showed a slight improvement on September although also remained in contraction territory.

Financial markets over the last few months have been dominated by a sharp rise in U.S. bond yields on the back of a American economy that continued to power ahead.

Yet the Fed's meeting last week and the softer U.S. data raised investors' hopes that the next move in interest rates will be down, causing global bond yields to drop and stocks and non-dollar currencies to rally.

The Bank of England also held interest rates, at a 15-year high of 5.25%, last week as it painted a gloomy picture of the UK economy.

Gross domestic product data, due on Friday, is expected to show the UK economy shrank 0.1% in the third quarter after growing 0.2% in the three months to June.

Reporting by Harry Robertson; Editing by Kirsten Donovan

Our Standards: The Thomson Reuters Trust Principles.

Bermudian Dollar

Bermudian Dollar2009BMD1002009BMD102009BMD202009BMD22009BMD502009BMD5

Hungarian Forint

Hungarian Forint2015HUF100002018HUF10002017HUF200002016HUF20002017HUF50002018HUF500

US Dollar

The US Dollar is the currency of the United States of America and several other countries and territories. It is also the most widely used currency in international trade and finance, and the main reserve currency of the world. Here is a brief introduction of the US Dollar:The US Dollar was

Comorian Franc

The Comorian Franc is the official currency of the Comoros, a small island nation located in the Indian Ocean. It was introduced in 1981 to replace the French Franc, which had been in use since the country's colonial period. The currency is issued by the Central Bank of the Comoros and is available in both paper and coin form. The exchange rate of the Comorian Franc is determined by market forces and is subject to fluctuations. While the currency has faced some challenges in the past, such