Sam Bankman-Fried is no 'villain' or 'monster,' defense tells jury

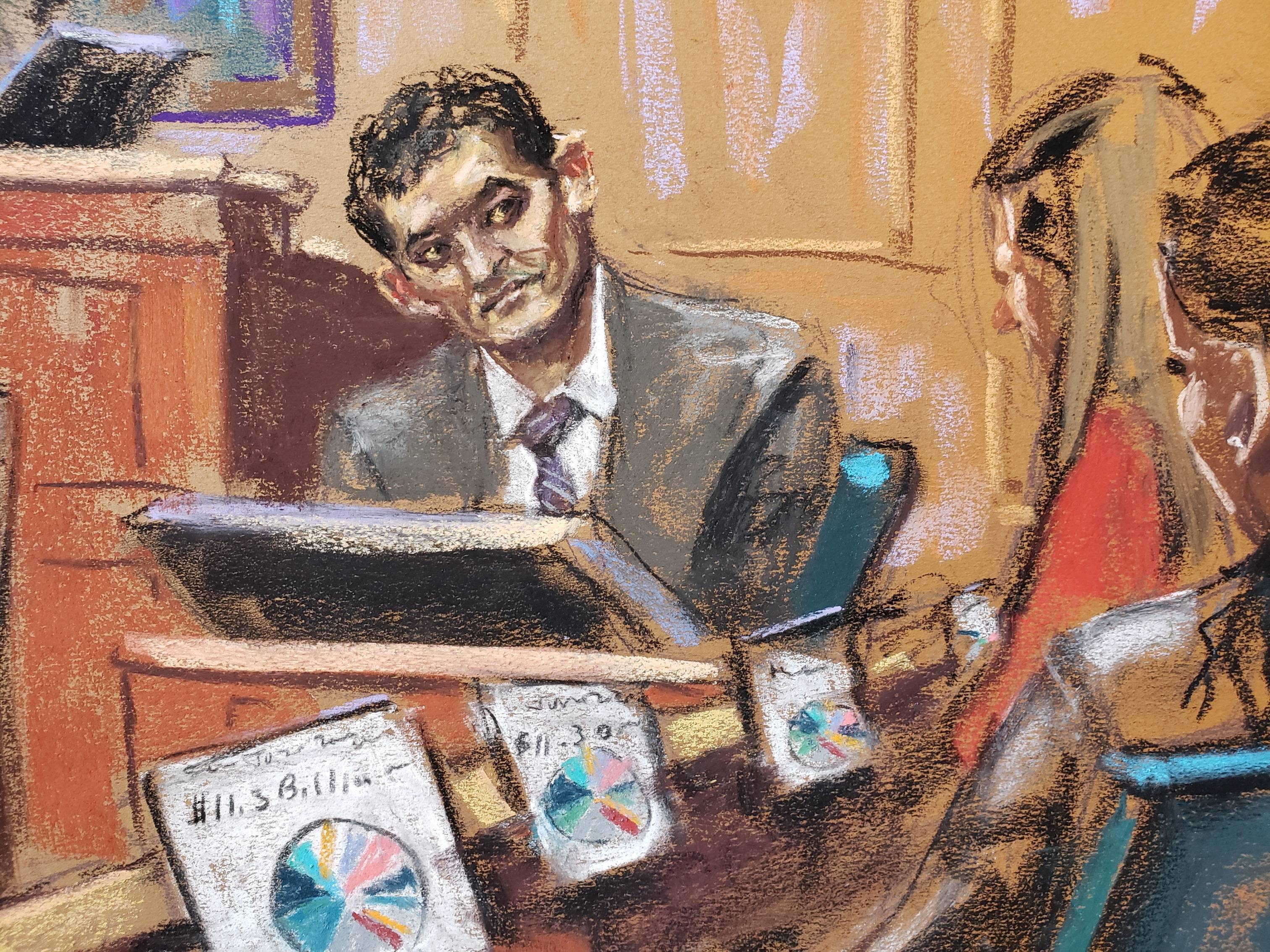

FTX founder Sam Bankman-Fried is questioned by prosecutor Danielle Sassoon (not seen) during his fraud trial over the collapse of the bankrupt cryptocurrency exchange at federal court in New York City, U.S., October 31, 2023 in this courtroom sketch. REUTERS/Jane Rosenberg Acquire Licensing Rights

NEW YORK, Nov 1 (Reuters) - FTX founder Sam Bankman-Fried's defense lawyer told jurors on Wednesday that prosecutors in his fraud trial sought to portray him as a "villain" and a "monster" because they could not prove he stole billions of dollars from the cryptocurrency exchange's customers.

Attorney Mark Cohen's closing argument in Bankman-Fried's trial in Manhattan federal court came after the prosecution urged the 12 jurors to convict Bankman-Fried, arguing he stole $8 billion out of simple greed in one of the biggest financial frauds in U.S. history.

Cohen said prosecutors elicited testimony about Bankman-Fried's sex life and appearance - the former billionaire was known for his unkempt mop of curly locks and wearing shorts and T-shirts - to try to get the jury to dislike him.

"Time and again, the government has sought to turn Sam into some sort of villain, some sort of monster," Cohen said. "And let's face it, an awkward high school math nerd doesn't look particularly villainous. So what did they do? They wrote him into the movie as a villain."

In his closing argument, prosecutor Nicolas Roos said Bankman-Fried directed other FTX executives to alter the exchange's computer code to allow a hedge fund he owned, Alameda Research, to siphon customer money.

"This was a pyramid of deceit built by the defendant on a foundation of lies and false promises, all to get money," Roos said. "He had the arrogance to think he could get away with it."

Jurors are expected to begin deliberations on Thursday after prosecutors give a rebuttal argument, meaning Bankman-Fried may learn his fate just shy of one year after FTX filed for bankruptcy in a swift corporate meltdown that shocked financial markets and wiped out what had been his estimated $26 billion fortune.

The defense rested its case on Tuesday after Bankman-Fried underwent a second day of tough cross-examination by the prosecution - the risk he ran by opting to testify in this own defense. Bankman-Fried, who pleaded not guilty to two counts of fraud and five counts of conspiracy, tried over three days of testimony to convince the 12 jurors of his innocence.

In all, the jury heard 15 days of testimony. Three of Bankman-Fried's former close confidantes, testifying for the prosecution after entering guilty pleas, said he directed them to commit crimes, including helping Alameda loot FTX and lying to lenders and investors about the companies' finances.

Alameda used that money to pay off its lenders and to lend to FTX executives so they could make speculative investments and donate to U.S. political candidates, prosecutors say.

Under questioning from Cohen, Bankman-Fried portrayed himself as a busy CEO who left operational nuts and bolts to subordinates. He made mistakes that harmed customers and employees, Bankman-Fried admitted, but never defrauded anyone or stole money.

"Poor risk management is not a crime," Cohen said on Wednesday. "The question of whether Sam's business judgment was reasonable, even if it later turned out to be mistaken, is not a criminal one."

Roos argued Bankman-Fried's digital fingerprints undermined the argument that he acted in good faith. Roos said Bankman-Fried had looked at a document as far back as June 2022 showing that Alameda had a large negative balance on FTX, as well as a spreadsheet Alameda's CEO Caroline Ellison - a prosecution witness - planned to send to lenders that hid its debts to FTX.

"As a result of sending out those fake balance sheets they got new loans," Roos said, adding that the financial statement hid the "crime-y, fraud-y parts" of Alameda's balances.

Bankman-Fried could face decades in prison if convicted on all counts. He has been jailed since August after Kaplan revoked his bail, having concluded he likely tampered with witnesses.

Reporting by Luc Cohen in New York; Editing by Will Dunham and Daniel Wallis

Our Standards: The Thomson Reuters Trust Principles.

Bermudian Dollar

Bermudian Dollar2009BMD1002009BMD102009BMD202009BMD22009BMD502009BMD5

Hungarian Forint

Hungarian Forint2015HUF100002018HUF10002017HUF200002016HUF20002017HUF50002018HUF500

US Dollar

The US Dollar is the currency of the United States of America and several other countries and territories. It is also the most widely used currency in international trade and finance, and the main reserve currency of the world. Here is a brief introduction of the US Dollar:The US Dollar was

Comorian Franc

The Comorian Franc is the official currency of the Comoros, a small island nation located in the Indian Ocean. It was introduced in 1981 to replace the French Franc, which had been in use since the country's colonial period. The currency is issued by the Central Bank of the Comoros and is available in both paper and coin form. The exchange rate of the Comorian Franc is determined by market forces and is subject to fluctuations. While the currency has faced some challenges in the past, such