Rainfall plays key role in capping Chinese aluminium capacity

Employees work at the production line of aluminium rolls at a factory in Zouping, Shandong province, China November 23, 2019. Picture taken November 23, 2019. REUTERS/Stringer/File Photo Acquire Licensing Rights

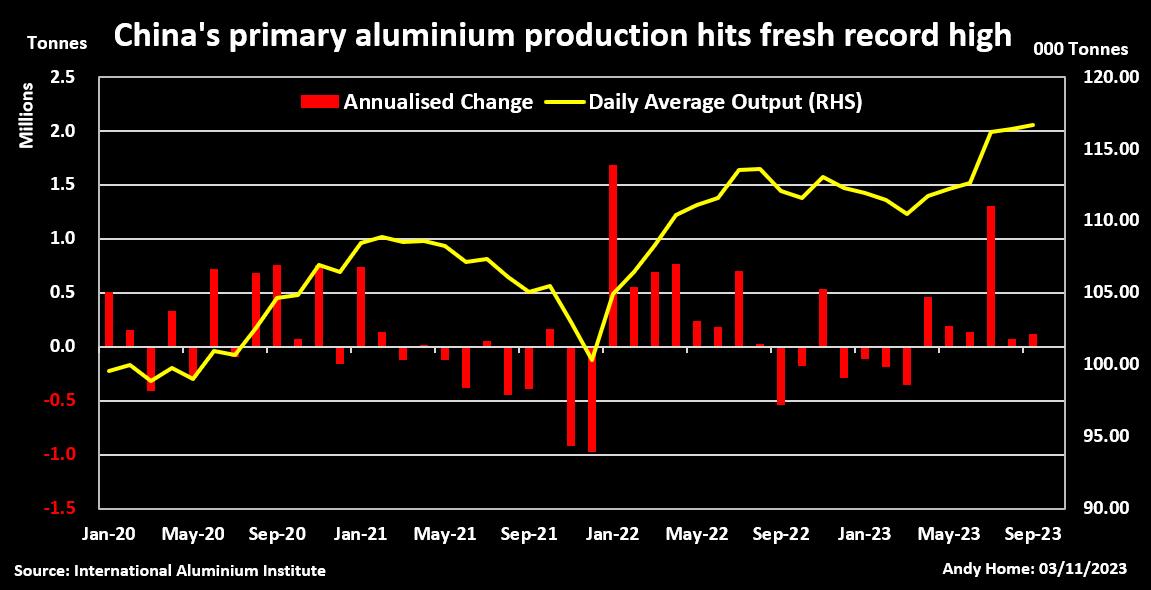

LONDON, Nov 3 (Reuters) - Another month, another new record for China's primary aluminium production sector.

Output in the world's largest producer of the light metal has increased by an annualised 2.3 million metric tons since March and hit a fresh peak of 42.6 tons in September, according to the International Aluminium Institute.

The production surge has refocused minds on the government's capacity cap of 45 million tons, a measure dating back to 2017 which requires new smelting capacity to be offset by closures of older plants.

Given the gap between operating rates and name-plate capacity, has the 45-million marker already been breached? Will Beijing stick with the ceiling or is there wriggle room?

And, more importantly, does it actually matter?

Smelters in Yunnan are once again being asked to turn off production lines as the hydro-rich Chinese province struggles to balance its power grid due to persistently low rainfall.

Power availability is proving to be as effective a cap on China's aluminium production as any government mandate.

NO RAIN STOPS PLAY IN YUNNAN

Smelters in Yunnan started powering down this week to comply with energy curbs over the southwestern province's dry season.

The cuts agreed with the China Southern Power Grid amount to around 1.15 million tons of annualised capacity.

The impact on operators will vary from 9% to 40% depending on the ratio of liquid metal transfer, according to AZ Consulting, which keeps close track of what's happening in China's giant aluminium sector.

Several producers have in recent years swapped out old smelters using coal-fired power in other provinces for new "green" hydro-powered plants in Yunnan.

Smelter capacity in the province now amounts to just over six million tons and until this week production was running at around 5.7 million tons, according to AZ Consulting.

Some of that production capacity has only just been powered up after a previous round of restrictions was lifted in June.

Indeed, the return of Yunnan's production has been a key factor in the country's record run rates over the July-September period.

But Yunnan has now passed its annual production peak and, given the province is the fourth-largest region for electrolytic aluminium, Chinese output has now also likely peaked.

WEATHER WATCH

This week's curtailments are expected to last until the return of Yunnan's rainy season in May.

But it all depends on the weather.

The province has been experiencing prolonged drought conditions, which is why smelters were only given the green light to lift production as recently as June and July.

While northern parts of the country saw some of the heaviest rain on record this summer, Yunnan didn't.

Precipitation across the region has improved on last year's low levels but remains well below historical averages, as my colleague John Kemp wrote in a recent column.

Droughts in consecutive years will severely deplete reservoir levels and constrain generation across a part of China that accounts for almost 80% of the country's hydro power generation capacity.

That has major ramifications for China's ambition to wean itself off coal, still a dominant source of power in many provinces.

It's also a big headache for local aluminium producers who must factor the weather into their operating plans.

However, in light of the rush to produce low-carbon aluminium, Chinese operators are still planning to shift even more capacity to Yunnan.

China Hongqiao Group (1378.HK), the world's largest private operator, is looking to move two million tons of capacity from the province of Shandong by the end of this year and four million tons by the end of 2025.

The move will slash the group's carbon emissions by 30% this year while moving more capacity to Yunnan will allow it to hit peak carbon in 2025.

RAIN CAP

But can Yunnan's hydroelectric system handle this additional capacity, given it is already struggling to balance loads between household and industrial demand?

The combination of more primary smelting capacity and less rainfall in Yunnan suggests seasonal curtailments are going to become a recurring pattern.

And an increasingly significant one as ever more Chinese aluminium capacity migrates from north to south to lower the carbon footprint.

China may be close to the government's capacity cap, but it is becoming clear that it can only operate at peak run-rates for a few summer months.

Rainfall in Yunnan is now the key determinant of China's primary aluminium production capacity.

The opinions expressed here are those of the author, a columnist for Reuters.

Editing by Paul Simao

Our Standards: The Thomson Reuters Trust Principles.

How do futures traders review their trading?

Futures trading is a form of financial speculation that involves buying and selling contracts that represent the future delivery of an asset, such as a commodity, a currency, an index, or a stock. Futures traders aim to profit from the price movements of the underlying asset, without actually owning

Futures night trading hours

Futures are contracts that obligate the buyer or seller to exchange an asset or commodity at a specified future date and price. They are used for hedging, speculation, and arbitrage purposes in the global market. Futures can be based on various underlying assets, such as currencies, commodities, ind

How can futures efficiently increase the success rate of intraday trading?

Intraday trading is a form of trading that involves buying and selling securities within the same trading day, without holding any positions overnight. Intraday traders aim to profit from the short-term price fluctuations of the market, using various tools and strategies to analyze and execute trade

What are the factors that can affect how much money can be made in futures?

Futures trading is a form of financial speculation that involves buying and selling contracts that represent the future delivery of an asset, such as a commodity, a currency, an index, or a stock. Futures traders aim to profit from the price movements of the underlying asset, without actually owning